The majority of our financial planning advice centres around providing a tax efficient income in retirement for our clients. However, during these conversations we are often asked how they can pass on assets to children and reduce their estate.

This leads us to the issue of inheritance tax (IHT), which can be a complex and rather daunting topic.

This guide explains the basics of IHT, how it is charged and how to manage it more effectively.

What is IHT and how much is the charge?

IHT is a tax charge (usually 40%) on any part of the estate that exceeds an individual’s personal allowance (also called the nil rate band). This is currently £325,000 per person. Your estate includes your property, savings, investments, any other worldwide assets, and any gifts made in the seven years prior to your death.

The charge drops to 36% if you give at least 10% of your estate away to charity when you die.

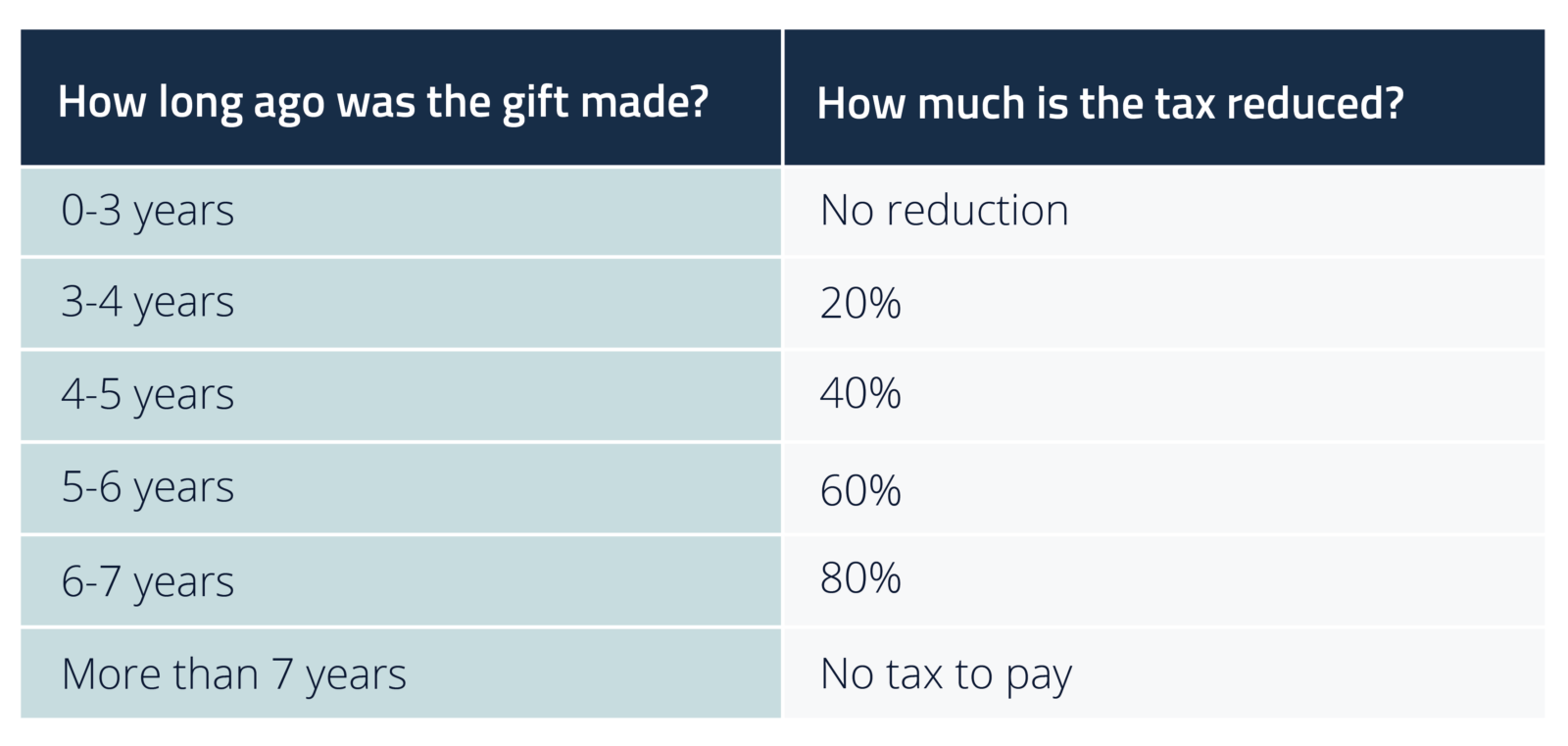

The reducing IHT scale, known as ‘taper relief’, is shown below:

The transferable residence nil-rate band

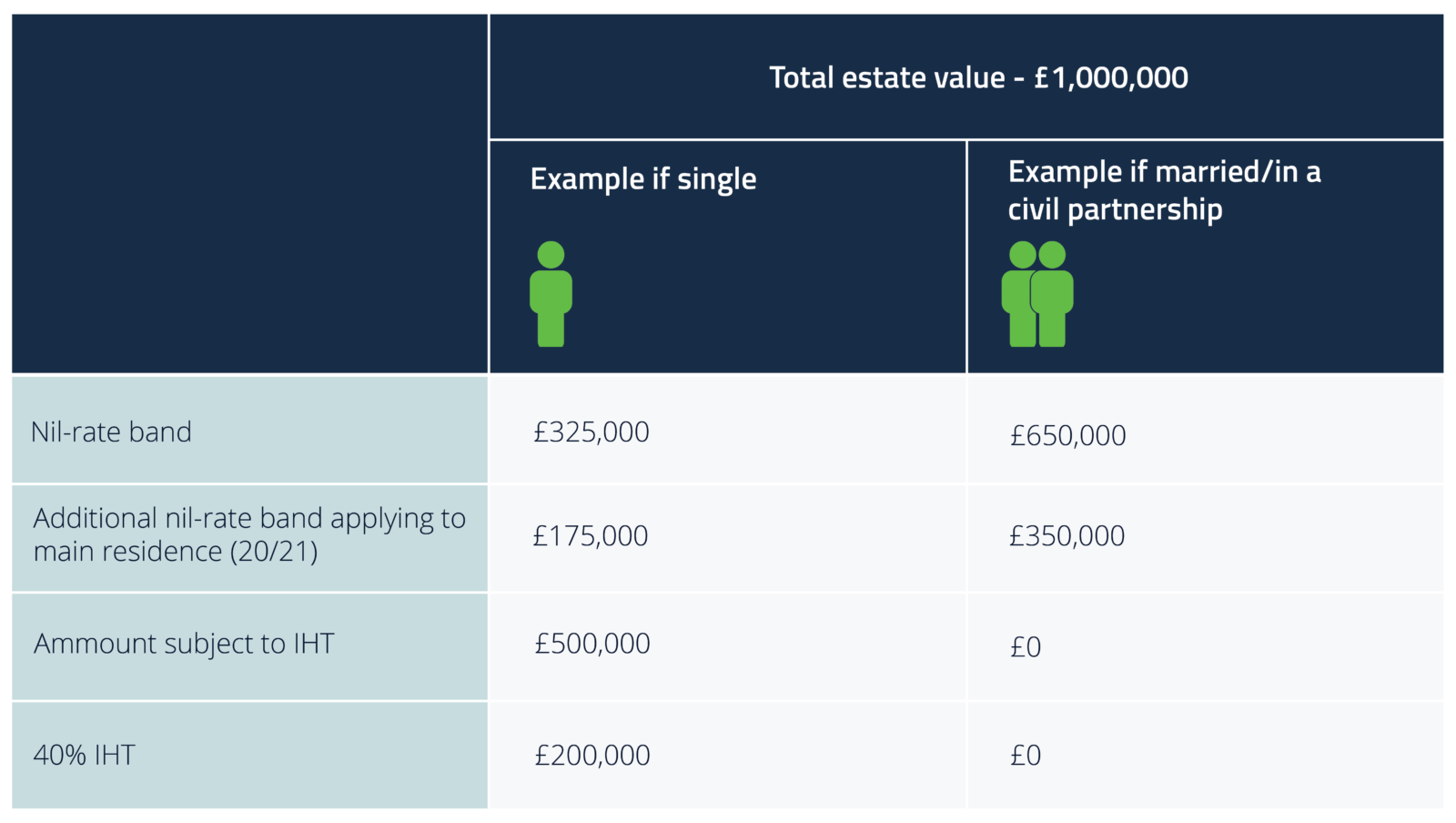

The biggest change in recent years to affect inheritance tax is the ‘main residence allowance’ which increases the inheritance tax nil rate band by £175,000 per individual.

This allowance is transferrable to a surviving spouse or civil partner, so the allowance could increase to £500,000. On the death of the second partner, the combined allowance could therefore reach up to £1m before any IHT is due, although only £350,000 can be set against the main residence.

This new allowance does, however, reduce for estates worth more than £2m.

Here is an example of the main residence allowance at work:

So, now that the basics of IHT has been covered, how can this be managed, and assets passed on to reduce the IHT exposure?

Wills

Making or reviewing a will isn’t something many of us view as a priority, until it actually becomes a priority – at which point it’s almost always too late to carry out any meaningful planning.

Having said the above, ensuring your will is as tax efficient as it can be, can potentially save you hundreds of thousands of pounds by ensuring that you qualify fully for all available allowances and reliefs.

We have been working with Stuart Hyden, a Partner at law firm EJ Winter & Son, to assist some of our clients with estate planning and wills and he makes the following comments:

- Unmarried couples can immediately save £130,000 of inheritance tax on the second death by incorporating a discretionary trust in their wills

- Business owners can make use of a little-known relief to pass their business assets into trust free of tax on their death so that these business assets are not taxed as part of their spouse’s estate on their subsequent death.

- Without a will, unmarried cohabiting partners often do not realise that none of their estate will pass to their partner when they die.

- Married couples with children are often surprised to hear that the amount that passes to their spouse is significantly limited.

- Those domiciled overseas are generally not aware that some of their UK assets will pass in accordance with the law of the country in which they are domiciled.

- Those who are UK domiciled with a non-UK domiciled spouse only have a limited spouse exemption of £325,000 for inheritance tax purposes rather than the unlimited spouse exemption that would otherwise apply.

Deed of variations

This allows the beneficiaries of a deceased’s estate to alter the distribution of the assets by altering the deceased’s will, for example, in favour of grandchildren, rather than directly to the children. In this example, the assets will not form part of the child’s estate and therefore be taxed again on the child’s death.

Gifts

Perhaps the simplest way of reducing your IHT exposure is to make gifts, which will avoid IHT if you survive seven years from the date of the gift:

- If you regularly have income left over which is surplus to your own needs and which does not affect your standard of living, you can use this money to provide a regular financial gift. There are certain rules surrounding this to ensure this income is surplus.

- Spouses or civil partners can gift any value to each other during their lifetime, as long as they are both domiciled in the UK.

- The annual gifting allowance is £3,000 per individual and you can split this between as many people as you like. If you don’t use it, you can carry it forward one year for a maximum allowance of £6,000.

- You can make any number of gifts of up to £250 each year to separate individuals. You cannot combine these with the annual exemption described above.

- Gifts to charities, museums, universities, sports clubs and some political parties are tax-free.

- You can make gifts to people getting married, up to:

- £5,000 from each parent of the couple

- £2,500 from each grandparent or remote relative

- £2,500 from bridegroom to bride (and vice versa) and between civil partners, or

- £1,000 from anyone else

Pensions

Pensions are probably the most obvious vehicle that is not included in the estate for IHT purposes. If you are fortunate enough to be able to draw income from other sources to fund your retirement and leave your pension intact, you will be able to reduce your taxable estate and pass on your pension without any IHT liability.

However, for most, the pension is the main source of income in retirement, and you must be very careful that drawing an income in this way is the right strategy for you – speak to your wealth manager!

Trusts and Life Insurance

Trusts are an effective option for estate planning but can be complex and costly. There are many different types of trusts – absolute, discretionary, interest in possession, discounted gift trust etc. Setting up a trust can enable you to retain control of the assets so they can only be accessed at a certain time and can also protect assets for the beneficiary.

Setting up a simple life insurance policy that will pay out the value of the tax will not reduce the IHT liability but will ensure it is covered. Life insurance can also be set up in a trust, so that the money can be accessed immediately to pay an inheritance tax bill.

The areas covered above are some of the simpler solutions to reduce your exposure to inheritance tax and there are undoubtedly more complicated and bespoke structures available. Inheritance tax is a complex area and often ignored. Planning now can save many thousands of pounds as well as complications later in life. Please speak to your wealth manager about your position.

If you want to learn more about IHT

- The content of this document is for information purposes only and should not be construed as financial advice.

- Any rates of return used are for illustrative purposes only. Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

- Any rates of tax referred to are correct as at the date of this document and may be subject to change in the future.

- We always recommend that you seek professional regulated financial advice before investing.