Tideway Responsible Investment Policy

Tideway Responsible Investment Beliefs:

Environmental, Social, and Governance (ESG) issues can be material for investment risk and return and therefore require consideration.

For example, a company’s greenhouse gas emissions may have a material effect on a company’s long-term profitability, sustainability and investor returns.

In addition to the potential for the material risks highlighted on the right, the climate crisis also leads to investment opportunities as countries engage in the race to net zero.

These investment opportunities are discussed at investment Committee level, as a thematic driver of above market risk-adjusted returns, and this is an area of focus for our manager due diligence.

Some climate change-related risks include:

- Regulation

- Taxation

- Competitive disadvantage

- Brand impairment

- Financing

- Physical asset impairment

- Litigation

Tideway Responsible Investment Philosophy:

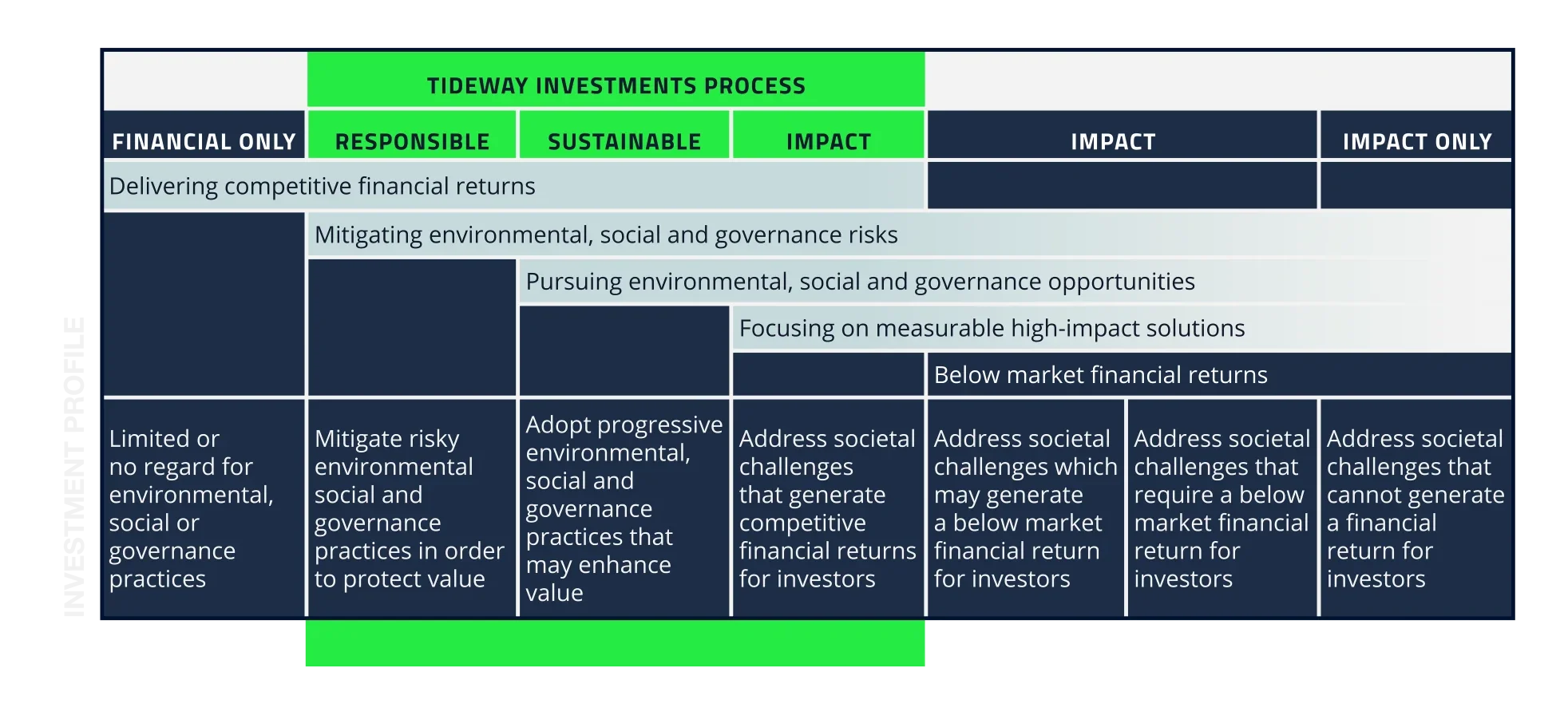

We have a fiduciary responsibility to our clients and therefore any Responsible Investment fund included in a Tideway portfolio will first and foremost need to exceed the required financial, risk-adjusted return objective.

We may include ethical, ESG and thematic funds within our universe of potential investment. However, Impact Funds, where there is an explicit non-financial objective which compromises the financial one, are excluded.

Organisation for Economic Co-operation and Development (OECD)

Tideway Responsible Investment Methodology

Responsible Investment process in detail:

- Initial Due Diligence Questionnaire Summary for review at Investment Committee level

- Independent Accountability at the Investment Committee level

- Independent Responsible Investment Review: analysis focuses on engagement. The review leads to a Responsible Investment “traffic light” assessment which is reported to the Investment Committee.