After showing us in January what might happen if inflation and interest rates were heading lower, that rally proved to be a false dawn. The rest of the year saw a frustrating up and down ride, slowly drifting lower as the debate to when and how far inflation and base rates would fall.

However, from a low point on the 25th October it’s been ‘Jingle Bells’ all the way into Christmas as inflation continued to collapse and as expectations for future inflation and base rates in 2024 fell.

Whilst the Bank of England have continued to tell us how tough the fight against inflation will be, the US Federal Reserve has now indicated there may be cuts in their base rate in 2024 with Fed watches speculating from 2 up to 6 rate cuts with a median expectation of around 4.5-4.75% by the end of 2024. Neither the Fed nor the Bank of England have reduced their rates yet.

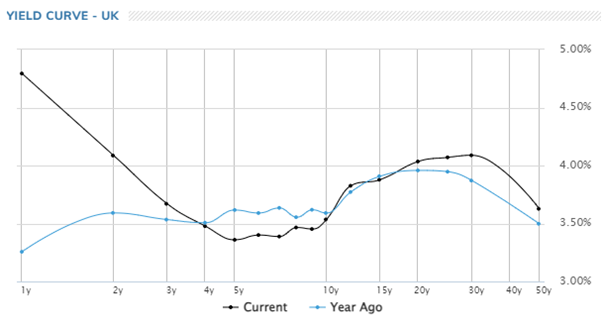

There has been strong demand for UK Gilts. As can be seen below, 5-10 year rates are now lower than they were a year ago and remember the whole of this yield curve (the black line) was above 5% in October this year. It’s been a big reversal move with gilt prices rising and yields falling.

Source: MarketWatch 22.12.23

The questions for 2024 will be whether markets have moved too far too fast, or on the other hand is the slowness to bring down base rates going to cause those recessions which have so far failed to emerge?

My suggestion is you reach for a glass of your favourite tipple, leave those worries to us, and enjoy the festive rally!

From that low point in October, all of our funds have been rising in value, the bond funds led the way but now the equity funds are also rallying, with some of our worst performing funds in the first 10 months of the year making the biggest gains in the last few weeks. Infrastructure, smaller companies, emerging markets and the value funds are seeing investors with more appetite rush in to buy these under loved investments. Some of these funds have started to outperform the S&P 500 index which, in its fever over AI, had pretty much ignored the interest rate inflation debate and rallied all year.

The net result is that pretty much across the board our portfolios are now up 6-8% for the year after all fees with almost all that gain coming in the last 8 weeks.

Nick Gait is taking the week off, but Edna Oliveros our marketing manager would like to share with you our plans for meeting our clients in 2024.

Happy Xmas

- The content of this document is for information purposes only and should not be construed as financial advice.

- Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

- We always recommend that you seek professional regulated financial advice before investing.