James Baxter

Founder

The main macro-economic news of the last two weeks has been the stubbornness of inflation and reluctance of central banks to cut interest rates.

Quoting from our own Bank of England’s monetary policy meeting this month;

“The Committee judges that the risks around its modal CPI inflation projection are skewed to the upside over the first half of the forecast period, stemming from geopolitical factors.”

“As a result, monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term in line with the MPC’s remit. The Committee has judged since last autumn that monetary policy needs to be restrictive for an extended period of time until the risk of inflation becoming embedded above the 2% target dissipates.”

One of those geopolitical factors is the reluctance of shipping companies to send their vessels through the Suez Canal for fear of attack and piracy. According to an expert I heard on Radio 4 last week it costs an eye watering $1,000,000 more in fuel per containership to go around the Cape of Good Hope, than to go through the canal when importing goods from Asia. More expensive than the extra fuel, it takes a good deal longer to go around the Cape, so more ships must be used to maintain supply chains. That’s not going to help inflation come down.

Whilst the base rate stays fixed at 5.25%, longer term rates, having fallen at the end of 2023, are drifting higher again. Nick Gait below explains why that’s good for how we are positioned in our fixed income funds, which we are seeing outperform their benchmarks again.

Arm Holding

I wrote a piece last year on the semi-conductor market, how it was a booming market and highlighting a few companies in the sector.

Last week Cambridge (that’s our Cambridge!) based ARM Holdings, designer of sophisticated chips and software shocked investors with a blow out earnings report that sent the share price up almost 50%. A quick read of the review of these earnings and those two words Artificial Intelligence (AI) pop out strongly. If there was any reason to doubt AI is having a massive impact on the computing and semi-conductor sector, ARM’s earnings puts those doubts to rest.

But that wasn’t the only reason the British based Arm Holdings share price pop caught my attention.

Some may recall that Arm was originally listed on the London Stock Exchange (LSE) making massive gains between its listing in 1988 and being taken into private ownership by Japanese Softbank in 2016. After a failed bid from Nvidia to buy the business from Softbank there followed intense political wrangling to get Arm relisted in the UK on the LSE. The first attempt by Boris Johnstone failed as his government went into crisis and a second attempt by Rishi Sunak to boost our post Brexit economy with a primary UK listing also failed. Softbank listed the shares on the Nasdaq last year at an IPO price of $51. It’s a sad indictment as to the ability of the UK, its financial services regulator, and the LSE to attract and retain fast growing companies.

At over $100 dollars a share and $100bn market value, Arm would now be one of the FTSE 100’s largest companies and a true global tech business. Softbank still owns around 90% of Arm, but the listed 10% would be worth roughly as much as say Legal and General and the huge share price rise this week would have given the index a much-needed boost. Softbank will no doubt sell more shares on the Nasdaq now at a healthy profit, the FTSE 100 index limps on!

The massive re rating of Arm’s valuation, got us thinking about our exposure to the increasingly important semi-conductor sector.

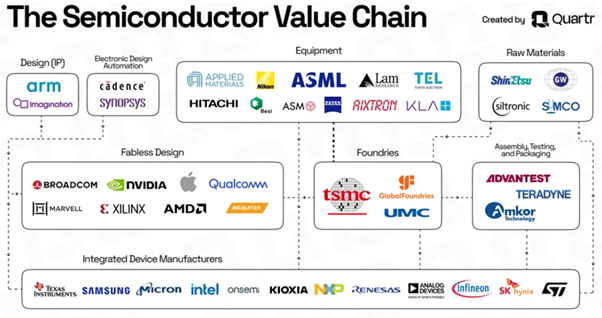

Nick found me the illustration below showing the many companies involved in the whole value chain, Arm is in the top left corner.

Our analyst Costa Michaelides then cross referenced these companies with our ‘funds look through’ on Bloomberg. This enables us to see which fund owns which companies and we can then aggregate them to see our overall exposure. It turns out we have a total of around 10% of our money in equities in companies in this sector.

Our biggest holdings from the illustration above are Samsung, ASML, Apple, Taiwan Semi, Broadcom, and Intel. We can look now to see what we think about this level of exposure. Do we like it or want to increase it further?

If we do want to increase our exposure to this lucrative sector, we won’t be investing in the FTSE 100!

Nick Gait

Investment Director

Continued opportunities in the short dated global high yield market.

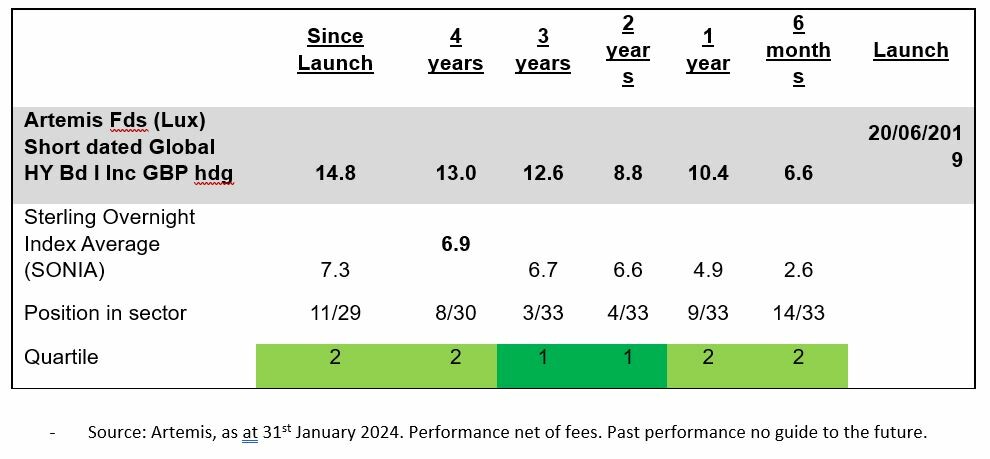

Arguably just as interesting as the world of fabless chip design and semi-conductor chip manufacturing, we thought it would be remiss of us not to draw attention to a less well-known opportunity which continues to be available in the short dated high yield market. We caught up with Jack Holmes, co-fund manager of the Artemis Short Dated Global High yield fund who highlighted a key opportunity which is perhaps being overlooked or is too dull for the wider investment community.

Short-term dated high-yield bonds are trading at both high yields (7.26% for the fund at the end of January) and for less than their face value. The high starting yield in isolation is interesting enough considering this figure is well in excess of inflation (real plus 3.25%). The differentiating factor, compared to some of our other fixed income investments, is that many of these bonds, trading at below their face or issued value, are expected to be paid back early which could result in returns above the headline yields. This is against a backdrop where the overall quality of these high-yield bonds is better than it has been in the past:

- Global bond yields have risen, causing cash prices of these bonds to decrease accordingly. Remember the hurdle rate for all investments increase as the government bond yield or risk-free rate increases.

- Historically, high yield bonds mostly traded over 100 (face value) after issuance, especially in environments where rates and short-term yields were less volatile where the primary reasons for bonds trading below par were deteriorating Credit quality and general risk off sentiment – We do not think either of these currently apply.

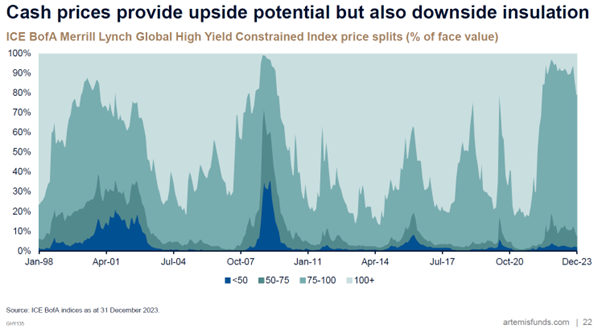

- As the chart below illustrates many bonds are currently valued in the 75-100 range, with only a relatively small section trading at ‘distressed’ levels below 50 – These are typically bonds which are most at risk of default and ones active managers are paid to avoid.

- This situation is more interesting than before due to the potential for these bonds to redeem early for more than their current price, at face value – 100. This is an opportunity hasn’t existed outside major crises. – see 2008 and 2009 below – many of the bonds traded below 50 indicating potential at risk of defaulting.

- Early redemptions, at par value (100) creates an additional return for the bond holder. Currently the average cash price is around 96. Assuming bonds are called 12 months early, the return is potentially even higher as the investors receive cash up front – the average cash price is currently 96.

- Even though the fund enjoyed a strong last 12 months returning over 10% to investors, we think the environment remains for strong forward looking returns.

Why are high yield bonds called early?

High yield bonds typically have provisions which allow management of companies to redeem the bond, typically 1-3 years before maturity, at a price of 100. This flexibility is unlike investment-grade bonds (which we also hold for added security), which often trade to maturity. High yield issuers prefer a c.3 year window to refinance, avoiding dependence on issuing bonds at a single point. As made clear by Artemis, early redemptions occur for three main reasons:

- Bank Facilities and Current Ratio: Bank facilities may have provisions around liquidity ratios (current ratio: current assets divided by current liabilities). Bonds nearing maturity become current liabilities, affecting this ratio and discomforting banks.

- Rating Agency Liquidity Considerations: Rating agencies focus on liquidity. Failing to repay/refinance in the final year is a red flag, prompting companies to address bonds early.

- Prudent Corporate Management: High yield companies rely more on open markets for refinancing. Management avoids bonds nearing maturity to ensure a conservative approach to risk management.

Higher yields don’t necessarily mean more risk:

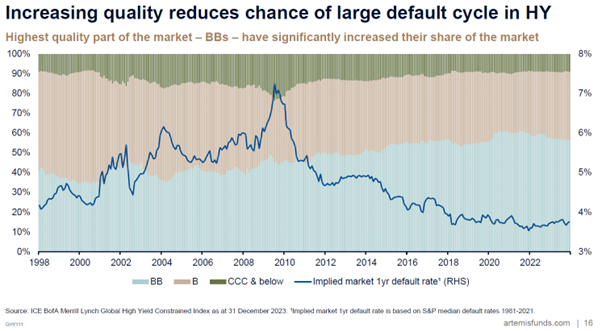

In general, the high yield market does not have the best reputation with the other common moniker for asset class being junk bonds. In reality however, the High yield market is higher quality than it has been in the past with a greater proportion of bonds in the stronger BB Credit quality and lower allocations to the weaker CCC credit quality echoing the previous chart where only a small proportion of the index.

This translates to lower default chances as seen by the 1-year implied default rate on the right-hand side of the above chart. As a reminder we invest actively and rely on manager’s detailed work at the individual company level to avoid the worst hit areas of the market when defaults do occur and would not advocate investing passively.

Summary:

Relatively unique opportunity in the short dated high yield market with issuers calling bonds back early at higher cash prices. This adds to the total return opportunity of the asset class which is already at healthy levels.

• The content of this document is for information purposes only and should not be construed as financial advice.

• Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

• We always recommend that you seek professional regulated financial advice before investing.