That is the last time I ever get excited about quarterly returns in one of these market updates!

Sure enough, on cue, the very nice rally in portfolios which we had enjoyed from the end of October 2023 ran out of steam at the end of March.

Our most popular Multi Asset Balanced portfolio (DD3 for those who like an acronym) which rose around 11% in those five months has now handed back just under 2% of those gains. The main US index the S&P 500 is about 5% off its peak in dollar terms, a weaker sterling / dollar exchange rate has softened those losses for us sterling investors. Our fixed income investments have not been entirely immune but are off less than 1% from their peak values.

The imminent drop in base rates looks less imminent as inflation remains sticky, especially in the US, less so in the UK. Geopolitical tensions are on the rise and earnings for the first quarter are a bit mixed. Or could it simply be that the five-month long rally simply had to pause at some point. This would be entirely normal market behaviour.

Should we be worried about big falls from here? We certainly don’t think so in our fixed income investments, where returns remain very attractive and ever more attractive as inflation falls. With UK inflation heading towards 3%, the 6%-8% interest we are earning in fixed income is delivering substantial positive real returns.

In equities we are also not too concerned on a market wide basis even though there is always a risk of a short-term drop. On January 2nd this year researchers FactSet highlighted that the S&P 500 had a forward price-to-earnings (P/E) ratio of about 15.5x, excluding the Magnificent Seven, while the Magnificent Seven had a P/E of about 35x. The wider market was not and still isn’t that expensive in historical terms. Tesla has taken the lead in helping to lower the P/E on the Magnificent Seven by falling 40% in value so far this year. Highlighting the risks of investing in single stocks even when you stick to the largest companies in the world.

On the issue of volatility in investments we note Moira O’ Neill for the FT Weekend has just published an article on the risks of volatility to drawdown investors and name checks Tideway’s Dual Account service. It will be in the Money section this weekend and Moira explains the issue really well, a must read for drawdown investors.

The Impact of 'Meme'

We do however see some bubbles out there and the topic of meme crypto currencies got a good airing on Wednesday evening this week at our Cheshire client dinner. If you have not been to one of our client dinners, do please take advantage of them. We had a great, relaxed evening and as much as anything, it’s always nice for our clients to meet each other.

Meme is a term for symbols or images used on social media to purvey messages quickly and graphically and we now have Meme crypto currencies and Meme stocks.

In the crypto currency world, some of these ‘Meme coins’ were made up for a joke and end up with billions of dollars betting on entirely useless instruments. Thailand is one of the first countries to ban trading in them. The specific wording of the Thai regulations states that these digital assets have “no clear objective or substance or underlying [value]” and that their prices are purely “running on social media trends.”

Nicely summed up I would say. But this culture is spreading into other asset classes, particularly where it is hard to put a finger on that ‘clear objective, substance or underlying value’. It’s not a new thing with speculative bubbles dating back to the tulip bubble of 1634, but with online trading and social media combined, it’s the amount of cash involved that stands out today.

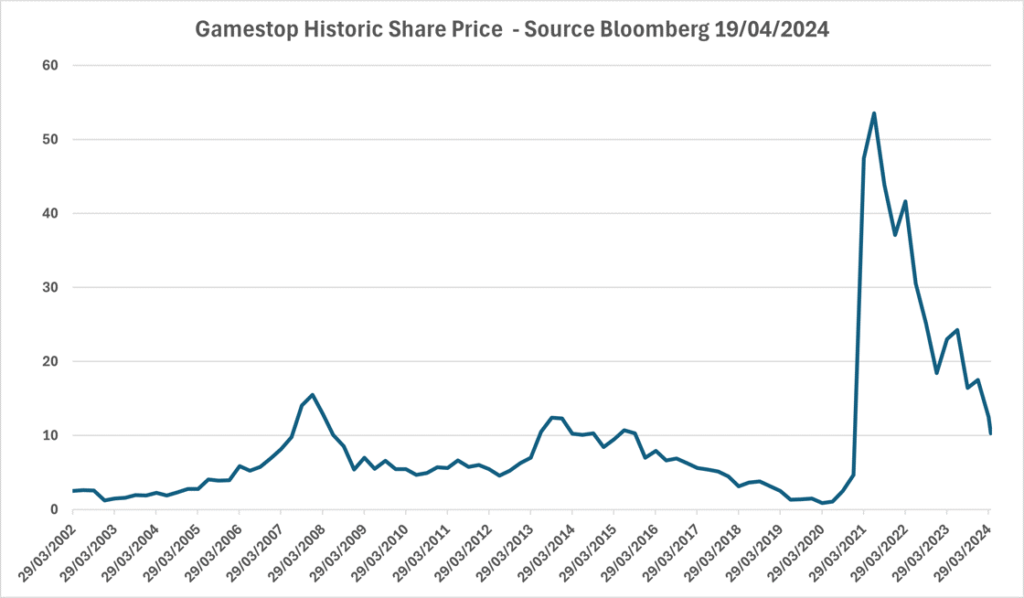

In stocks the first Meme stock was Gamestop (GME) in 2021.

A pretty useless chain of video game shops in the US and one of the most heavily shorted stocks in the US in the run into the covid lockdowns. Private investors using online platforms such as Robinhood and social media platforms such as Reddit, started buying Gamestop shares forcing up the price and ultimately creating a short squeeze where those who had been shorting the stock based on its relative failure as a commercial enterprise ended up having to close out their positions by buying stocks at elevated prices so contributing to the price rise and their own losses. Gamestop earned just $6.7m in 2023 but still has a market cap of over $3bn dollars, although it managed to raise cash in the frenzy for its shares and sits on $1bn of cash.

Since the concept of a Meme stock was invented by Gamestop there have been several more examples.

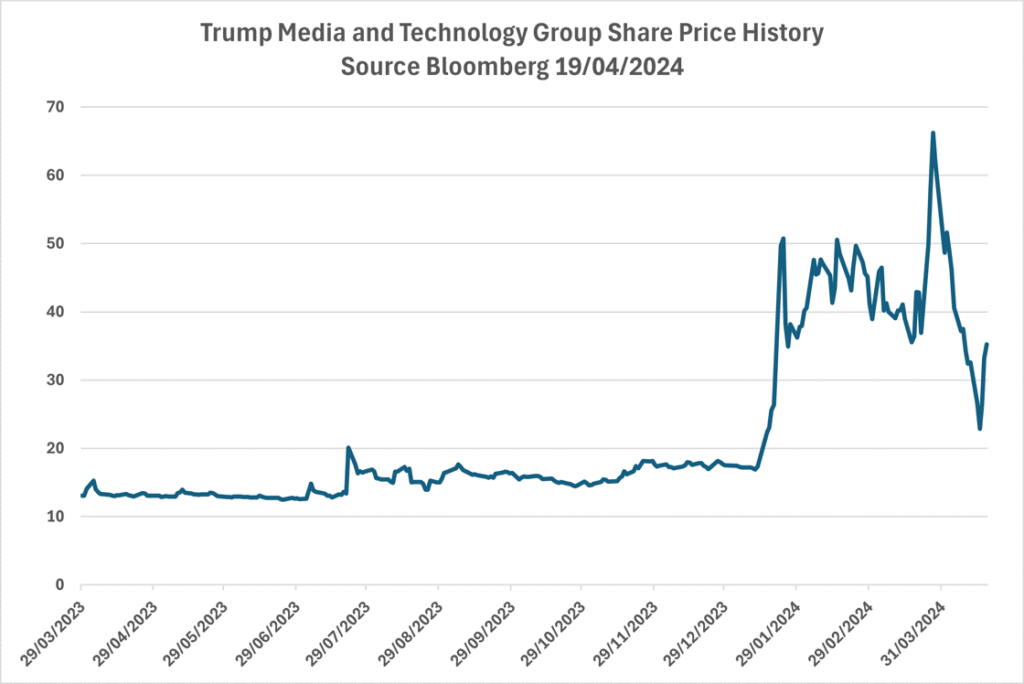

Donald Trump’s media business with the ticker DJT became the most recent stock to be classed as a Meme stock with its price doubling then halving again in a matter of weeks.

The full-year figures for DJT were aptly disclosed in new and revised SEC filings on April’s Fools Day showing: “Trump Media & Technology Group, the newly formed company whose assets include nascent social media platform Truth Social, has reported 2023 revenue of $4.1million (less than Tideway!) and a net loss of $58.2 million”. Some investors bought shares valuing this business at $9bn.

The staggering thing about these stocks is the amount of money changing hands at these peak values. If Yahoo finance is to be believed, at the very peak of their valuations, just before the bubble burst, c5bn of GME shares changed hands and c130m in DJT. If you multiplied this by the share prices at the time these are staggering amounts of speculative money. Online speculators are betting billions of dollars on these stocks, whose bubbles are often bigger than anything ever seen in the dot com bubble. Clearly there are a lot of people out there with more money than sense. We will leave them to it!

Most of these Meme stocks are small enough not to impact broader indices and are easy for our active managers to avoid. We won’t feel the impact of DJT’s rise and fall. But Meme culture is affecting some stock valuations that will impact indices and particularly with the backdrop of the potential riches that might come from AI, such speculation can distort share prices. Time will tell whether Tesla will have been the mother of all Meme stocks with a valuation that was driven way higher than any other car manufacturer around the world. If it does it will finally vindicate many active managers who have given it a wide berth.

Whilst we are studiously avoiding these bubbles we do worry about the wider impact if the bubble bursts on crypto currencies and whether that would spread into the wider economy…..the bursting of the tulip bubble didn’t in 1634!

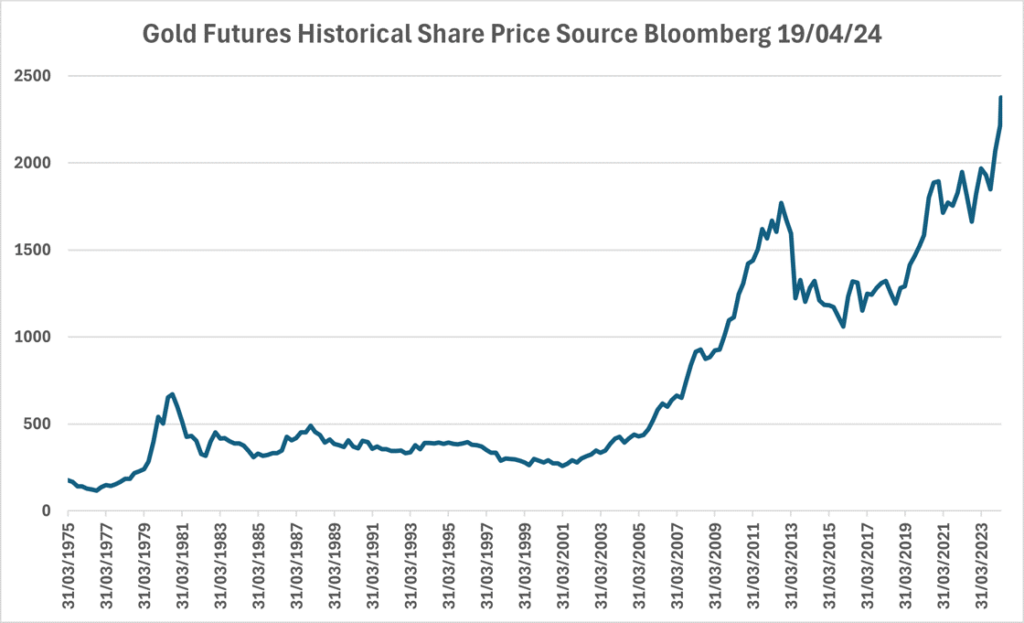

We were asked about investing in Gold on Wednesday evening, but this again we will leave for others to speculate on.

Gold prices have been on a tear of late and over the long term have generally risen. We hear the arguments for holding gold but again there is no intrinsic value, little purpose for gold in modern society and it generates no income along the way. Speculators who bought gold in 2012 at the last peak had to wait more than a decade to make any significant increase in value. That’s a very expensive insurance policy against Armageddon!

So, we stick to the knitting! We know the intrinsic value of what we own and the likely returns available to both short-term and long-term investors. We can then consider the relative merits of these investments against the risk free 4% p.a., a now inflation plus return available from UK Gilts, to see whether they warrant a place in our portfolios.

We will leave the speculation to others.

Suscribe to our biweekly Market Update

- The content of this document is for information purposes only and should not be construed as financial advice.

- Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

- We always recommend that you seek professional regulated financial advice before investing.