What is a Pension?

A pension is an investment vehicle designed for an individual’s retirement. The current UK legislation and the tax treatment of a pension incentivises people to enrol into a workplace or personal pension scheme, contribute to it monthly and remain invested over the long term until they approach retirement or the minimum pension age.

Types of pensions:

There are three main types of pension arrangements:

-

- The State Pension: this is a pension provided by the UK state, subject to legislation, which provides a monthly payment based on the entitlement you have accrued throughout your working life via National Insurance contributions. (1)

-

- Defined Benefit Pension: a pension payment guaranteed by your employer/sponsor built up during your employment. This will be a specific payment, with the option of a lump sum, and increasing in line with scheme rules.

-

- Defined Contribution Pension – a pension pot where the member (and potentially the employer) contribute throughout the member’s tenure with the employer. This is then invested and can be accessed at age 55 (scheduled to increase to 57 in 2028).

For the purposes of our analysis, we will focus only on DC pensions vs ISAs (as the State Pension and a DB pension entitlements are determined by government legislation and company rules respectively). If you want to learn more about DB Pensions, read our latest article.

- Defined Contribution Pension – a pension pot where the member (and potentially the employer) contribute throughout the member’s tenure with the employer. This is then invested and can be accessed at age 55 (scheduled to increase to 57 in 2028).

Pros and cons of a DC pension:

Pros

-

- You will receive basic/higher/additional rate tax relief on any contribution made depending on your earnings

-

- The amount invested within the pension can grow without any tax payable

-

- Currently you can access 25% of your pensionable tax free at pension age

-

- You can pass on any residual pension to future generations

-

- Pensions are currently free of any Inheritance Tax

-

- Your employer will usually match the contributions you make into your pension whilst working

-

- You can carry forward any unused Annual Allowance

Cons

-

- You cannot access the pension until the minimum retirement age (currently 55, increasing to 57 in 2028)

-

- Favourable pension legislation may change in the future when the time comes to access your pension

-

- You can only make tax-relievable contributions until age 75

-

- You are limited by the lifetime allowance on the total amount you can accumulate in a pension tax efficiently

What is an ISA?

An ISA (Individual Savings Account) is another type of investment product, with a different tax treatment than a pension (detailed below). All income and growth generated is tax-free and an investor is able to invest up to £20,000 annually in total into an ISA arrangement.

Types of ISA:

There are 4 types of ISAs:

-

- Cash ISA – These are cash savings accounts that pay interest tax-free.

-

- Stocks & Shares ISA – These are ISAs where you can invest in underlying stocks and shares. Your total ISA pot then depends on the investment performance (there is no tax to pay on any income or capital growth).

-

- Innovative Finance ISA – These allow you to lend money to different businesses and receive tax-free interest. However, there is a risk of default as many of these businesses tend to be start-ups or young companies.

-

- Lifetime ISA – These allow first-time buyers to save money, topped up by a 25% government bonds (up to £4,000 in a tax year) in order to purchase their first property.

Pros and cons of an ISA:

Pros

-

- No tax payable on any income or growth

-

- The funds are easily accessible

-

- You can invest in a range of underlying investments (except Cash ISAs)

-

- The ISA can be inherited by the surviving spouse upon the member’s death

-

- You can split your annual £20,000 allowance however you want across the 4 types of ISA (although you are limited to £4,000 gross in a Lifetime ISA).

Cons

-

- You are limited to a contribution of £20,000 per tax year

-

- You cannot carry forward any unused allowance

-

- No tax relief available on contributions

-

- You may not be able to replace any withdrawn money

-

- An ISA forms part of your estate for Inheritance Tax purposes

Key differences between pensions and ISAs:

| Pension | ISA | |

| Annual allowance | Depends on your earnings (up to £40,000 gross per tax year) / £3,600 gross if you do not work | £20,000 |

| Tax | No tax payable on income or growth whilst invested | No tax payable on income or growth |

| Investment | Can invest in a range of investment choices | Can invest in a range of investment choices |

| Accessibility | Cannot access until at least minimum pension age 55 (increasing to 57 from 2028) | Instant access |

| Making contributions | You will receive basic rate tax relief at source and potentially higher and additional rate relief depending on your earnings | No tax relief |

| Upon death | Exempt from Inheritance Tax | Will be subject to Inheritance Tax |

Financial comparison between pensions and ISAs:

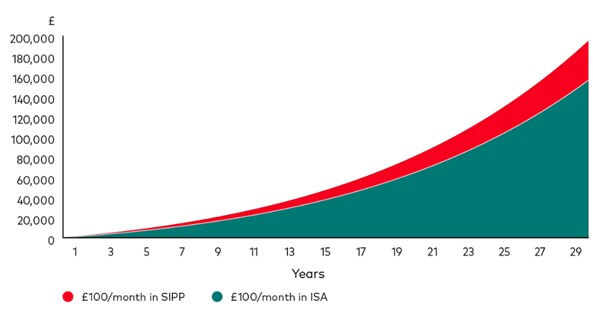

Both pensions and ISAs offer attractive compounded rate of returns when held over the long-term:

Please note that the above assumes that contributions increase by 5% each year, with an annual return of 5% (after any fees).

Should I choose a pension or an ISA?

Both pensions and ISAs remain attractive, tax-efficient vehicles and both should form part of your financial planning in the future.

The main things to consider when choosing between them are:

-

- You are unable to access a pension arrangement until 55 (scheduled to increase to 57 from 2028), whereas you can access an ISA at any point

-

- You can contribute a maximum of £40,000 gross into your pension per tax year (depending on your earnings) versus £20,000 for your ISA

-

- A pension contribution attracts tax relief whereas an ISA does not

-

- You can potentially carry forward any unused Annual Allowance from your pension to future tax years, whereas you cannot do this with your ISA

-

- A pension is free from Inheritance Tax whereas an ISA is not

-

- If you are a high earner, you may be impacted by tapering rules, which can limit your pension contributions to a maximum of £4,000 gross. Your ISA allowance remains unaffected.

For more articles like this visit our News & Insights.

The content of this document is for information purposes only and should not be construed as financial advice

Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise

We always recommend that you seek professional regulated financial advice before investing

Any references to forward-looking yields does not represent the future performance of the portfolio and should not be taken as an indicator of potential performance