James is taking a well-deserved break this week and so I have taken the pen to share Tideway’s thoughts on markets and portfolios. I will avoid commenting on individual companies and so will be focusing on the discussions the advisers have been having with our clients in the last few weeks and the questions we are often asked.

Firstly, the good news is that portfolios have performed well since our last note towards the end of October – inflation and job’s data in the US and in Europe has been supportive and Central Banks have held rates, pushing up both fixed income and equity markets.

Regular readers will no doubt be aware of our bias towards fixed income within portfolios and our positive view of this asset class. We have been waxing lyrical about fixed income for some time, extoling the attractive yields and income on offer and the recent performance. However, some clients have struggled to see the positive return of these bond funds within their multi-asset portfolios, which includes equity and alternative funds – the long list of funds and the more subdued returns of the equity and alternative funds have overshadowed the bond success.

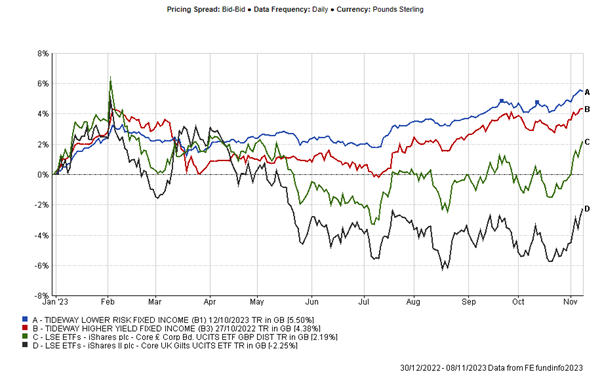

In the chart below, I have shown the returns of our low risk Bond portfolio (B1, blue) and our higher risk Bond portfolio (B3, red) so far this year against the broader Corporate Bond (green) and UK Gilt (black) indices.

Clients invested in our multi-asset portfolios (DD1-4) will have a percentage of these fixed income assets within their wider portfolio.

What conclusions can we draw from this chart?

- Our fixed income funds are performing (!!) and have delivered a return of around 5% so far this year. These funds are held almost exclusively within pensions and ISAs and so this return is tax free, unlike saving accounts.

- Within fixed income, being short-dated has helped – we have been moving increasingly towards short-dated bonds over the past 12 months. The short-dated, lower risk B1 portfolio has slightly outperformed the longer dated, B3 portfolio. But more crucially, against the broader fixed income market, including much longer-dated bonds, the return differential has been significant – over 7.5% from UK Gilts and 3.0% from UK Corporate Bonds.

- Lastly, active management also works. We have previously written about this but having a firm (Tideway) that understands what is held within each fund as well as the fund manager (Artemis, Royal London etc) who understands the individual companies and bonds that are issued is vital. Nick and Costa certainly have this covered. With 100s of fixed income funds to potentially buy, mistakes are easy to make and returns can be given away.

For those clients who are drawing an income from their portfolio, these bond funds are paying a very handsome cash income – this is the regular coupon payment (paid monthly, quarterly or six-monthly, depending upon the fund) and does not include any capital gain as the price of the underlying bond increases.

For a portfolio of £500,000, the cash income that can be expected in the next 12 months is in the region of £25,000 (B1, low risk) to £35,000 (B3, higher risk). Many clients can now simply rely on the income from these bond investments to fund their retirement income. This income is reliable, consistent and sustainable and the underlying volatility of the asset much lower than equities. They can then have an allocation to higher risk equities for the longer term, knowing that they do not need any immediate access to these funds. They do not (or certainly should not!) have to worry about the short term volatility. This is our Horizon planning in practice.

An important consideration (and regularly asked) is that of cost. The cost of these Bond portfolios are now between 0.41% and 0.68% and the returns shown in the chart above are after these fees.

The FCA’s new “Consumer Duty” places a heightened responsibility on firms to consider the price and value their services and products offer their clients – something we are focussed on at Tideway.

Recent press attention on St James’ Place has highlighted the combination of their multi-layered and opaque fee structure; poorly performing ‘dog funds’; exit charges that ensures client loyalty; sales-orientated business model; and the challenge of loans that have been taken out by individual advisers to ‘buy’ clients from retiring colleagues as areas that are difficult for St James’ Place to reconcile with the new FCA Consumer Duty obligations. This has been another recent topic of conversation with our clients.

James has been in the Financial Times likening their business practice to that of a 1980s Ford Cortina.

At Tideway, our fees are clear and simple (with no exit charges) and our culture is one of collaboration with no sales-based incentives for advisers. We are not tied to another one provider or fund group and if, on occasion, fund performance disappoints, we are free to switch funds. Our clients are at the centre of all we do.

On a personal note, I had a chat with St James’ Place many years ago. I was staggered by their fees and how much of the conversation focused on how much money I could potentially make. I don’t remember hearing much about their client offering. Over 15 years later, I still can’t understand their fee structure and it appears from the recent press articles that I am not alone.

We have had a few enquiries from current St James’ Place clients (we welcome many more…!!) and having explained Tideway’s proposition we are delighted that we have had clients choose to join us from St James’ Place.

From a retirement income perspective (which many of our clients are considering), we have studied some of the big players’ approaches and we’ve seen portfolios heavily invested in equities and potentially illiquid property funds, with a small exposure to fixed income and absolute return funds.

This high equity exposure is unnecessary both in terms of risk and income for retired clients or those approaching retirement. High risk, low income should be largely replaced by lower risk and higher income. And back we are to fixed income…

To read more about St. James’s Place business model visit our webpage.

- The content of this document is for information purposes only and should not be construed as financial advice.

- Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

- We always recommend that you seek professional regulated financial advice before investing.