We have passed the end of the first quarter and will be hosting our online webinar on Monday evening next week at 6pm. Our Investment Director Nick Gait will also give a full review of our portfolio returns and market movements in his quarterly report which will be included in your quarterly performance report downloadable from the Tideway App in the next few weeks.

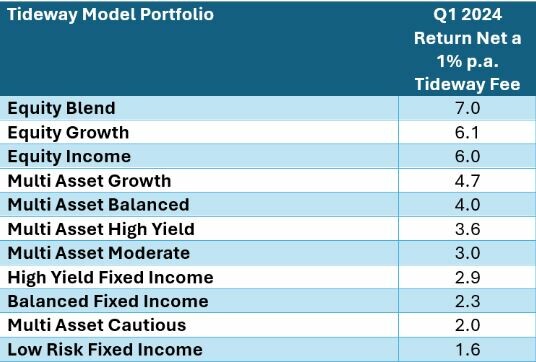

In the meantime, a few quick thoughts from me. Here below are our model portfolio returns net all fees for the last three months:

Source: Tideway & FE Analytics 31/03/2024

Bear in mind these are for just three months not a year, and yes you can multiply them by 4 to see what that would look like over a year if they continued at this rate but it may not be as simple as that and I share more thoughts on this below.

Will they continue at this rate?

I have just asked Nick the same question and we agreed that if you start at the bottom of the table and work up, our ability to predict whether the returns will continue decreases.

At the bottom of the table, we believe that our low-risk fixed income portfolio is well placed to continue to make these returns and is on track to earn around 6.5% for the year after fees. With inflation falling to 3.4% in the UK and set to fall further that’s not a bad return after fees and currently better than a cash deposit account. This portfolio is more stable, taking a very modest amount of risk and this is what we will be using to buffer withdrawals going forwards for those who take advantage of our new Dual Account Drawdown Service.

There has yet to be any drop in base interest rates either in the US or UK. Longer term rates have been moving around as investors speculate when base rates might start to fall, but even in our next two higher risk fixed income portfolios we have very little exposure to longer dated bonds. The forward return on the high yield bonds we are invested in is still around 8%. So yes, we think around 10% for the year on these two fixed income funds is achievable, given that the active managers can usually add a few percentage points to the bottom-line yields.

The lowest risk Multi Asset fund is mostly fixed income and has quite a big exposure to the lowest risk fixed income fund so 8% from this fund is entirely possible.

Going up the table we get more exposure to equities and that removes a big chunk of less volatile returns. In Q1 that extra risk was royally rewarded but we know that won’t always be the case. The risk of market downturns in equities is always present.

For the longer-term investor, moderately higher inflation generally means higher nominal equity returns. We would expect an average return of around 8-9% per year with inflation averaging 3%. So straight away we can see 7% in three months is not sustainable indefinitely. But equity markets rarely make average returns in any one year, it is usually a lot more or a lot less as fear and avarice push prices either too high and too low.

This table below from YCharts caught my eye showing S&P 500 returns in US dollars on a year-by-year basis and shows clearly anything could happen next!

Source: Ycharts 05/04/2024

A 28% return from equities for the year is not certain but it is certainly in the realm of possibility, two big returns one after the other are also not that uncommon. It is worth noting the 18% drop in 2022 pretty much coincided with peak inflation of almost 10% so represented a real drop after inflation of almost 30%. Not as big as 2008 but still a big correction in real money terms.

Why did the Equity Blend Portfolio do so well?

That was my number two question to Nick this morning and the answer comes down to one fund, Artemis Global Income, which has had a stellar run.

Nick will give a more detailed commentary in his quarterly review, but this fund outperformed the S&P 500 index by almost 3% in the quarter thanks to its exposure to Japan and some very clever stock picking.

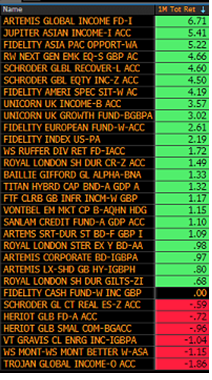

One point Nick did note, which has been commented on elsewhere by other investment commentators, is that the recovery in equity prices appears to be ‘broadening out’. Other parts of the equity market away from the US tera caps are starting to do well.

This table from Bloomberg this morning (don’t blame me for the presentation!) ranks all our funds on one month returns and we can see 10 out of 15 of our active managers outperforming the Fidelity S&P 500 index fund.

Source: Bloomberg 04/04/2024

Returns in 2019 and 2023 were very much driven by the digital tera caps and this has driven a widening in valuations between very biggest companies in the world and smaller and mid-sized companies. This difference in valuation is now inverted. Usually, small caps are valued more highly than big caps, right now it’s the other way around. Plus the gap in valuations big to small cap is close to record levels. Small caps having gone from an average 20% premium to 6-10% discount as compared to big caps. Noting these days the small cap entry point on a global basis is around $4bn in value, so this would exclude St James’s Place ($3.2bn) now bottom of the UK’s biggest FTSE 100 companies (I could not resist that!).

Eagle eyes may have noticed that even Ruffer made a decent return in the last month.

Going back to the original Tideway portfolio return table you can see we are now running 11 model portfolios in total. Three equity, three fixed income and five multi asset portfolios. On demand we have added a higher risk multi asset portfolio plus a higher yield portfolio which we designed specifically for our offshore bond users.

I like to think of these portfolios as colours on the palettes for our wealth managers to mix for you to meet your objectives and risk appetite. Right now we think the return outlook is particularly good on a risk adjusted basis for our fixed income investments, but we do expect to get the best returns from equities in the longer term.

If you have any questions on this, or concerns that you don’t have the right mix, do please get in touch with your adviser who is here to help. The new Dual Account facility for SIPPs allows us to run two models in one account. This is particularly helpful to those looking or needing to withdraw higher incomes and potentially also allow them to invest in higher risk portfolios for their longer term investments. We hope to be getting some press coverage on this in the coming weeks.

– The content of this document is for information purposes only and should not be construed as financial advice

– Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise

– We always recommend that you seek professional regulated financial advice before investing