Since I started working in the industry and having open investment discussions with clients and investment professionals each period of time there has always been a theme to the investment discussion, often it is the biggest known economic concern at the time, recently it has been inflation and interest rate rises but before that it was Covid and before that Brexit.

We saw inflation figures fall this week and whilst interest rates were held, the market continued its rally as it seems they have peaked and are more likely to drop later in the year than rise, good news for investors and markets alike. So, what is next Sam? My discussions with clients have already started to move on.

Well, what I do know is 2024 is going to be the year of the elections. Not just here in the UK we are due an election but also across the Atlantic in the largest Western economy, the States go to an election scheduled for November, Biden vs Trump the rematch. 2024 also has elections due in a number of other large countries including India, Mexico as well as the EU parliament.

So what effect is this going to have on the markets and more importantly for those reading this, your portfolio. Markets like certainty and don’t like uncertainty, elections are certain, they are happening, and so outcomes can often be looked through and predicted by markets. Here in the UK the opposition tactics seems to be don’t say anything to outrageous, markets like that, and let the current government self-implode which the polls suggest has thus far been a strategy that is working.

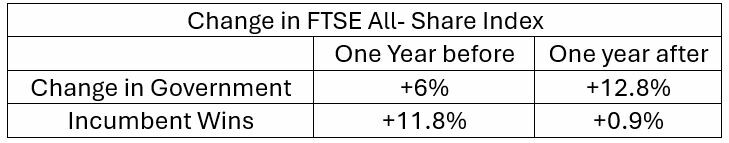

Therefore, markets have already factored in the outcome, so only an unknown factor will change that. AJ Bell undertook some research and evidence suggest that a change in government often lead to stronger rally in the FTSE Allshare for their first 12 month in charge and the year before election are also positive. So, a changing government and change of direction is usually positive thing rather than a negative thus should not be feared, however really the general economic backdrop is much more impactful.

However, across the pond, Trump vs Biden seems to be a much spicier affair and with the outcome at this point up in the air. As I mentioned earlier, the USA has the largest Western economy and therefore will be more impactful on the global markets than a UK election. However, whilst Americans have strong differing views on whether you are a Democrat or a Republican, America is much more capitalist country than the UK and they all support a growing economy.

A Biden administration will support growth through reinforcement of the current plan of investment in infrastructure, transportation and manufacturing whereas a Trump administration is likely to lower corporation tax, pressurise the FED to lower interest rates and support the real estate market. America is a strong economy in a strong position and has become an increasingly insulated and self-sufficient economy over recent years, a Trump administration would further cement this. The general view whilst the election outcome is uncertain there will be short term volatility but both outcomes will support an economy and have a strong starting position to do so.

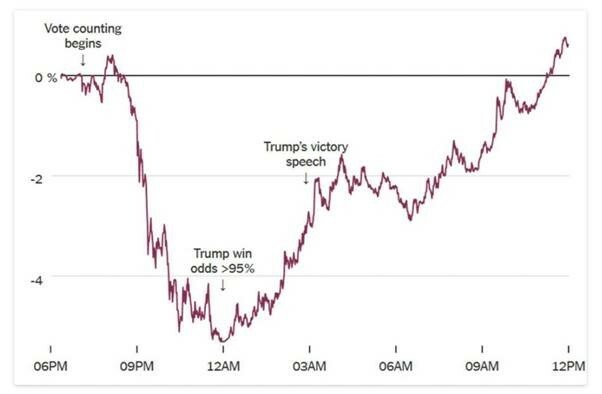

Below is a graph that shows the S&P500 on November 8th & 9th 2016. US election day in 2016, if you cast your minds back, to that election day a Hilary Clinton White House looked odds on to win! And so, the fact that didn’t happen and we in fact had a Trump victory was a bit of a shock and markets reacted.

S&P 500 futures on 9-10 November 2016. Source: The New York Times

As the votes came you can see the uncertainty creeped in and the result becomes unclear, not what was predicted. However, it didn’t last long and the market was positive again within 36 hours once an outcome was clear. Whilst Trump is a divisive figure he was going to support the US economy.

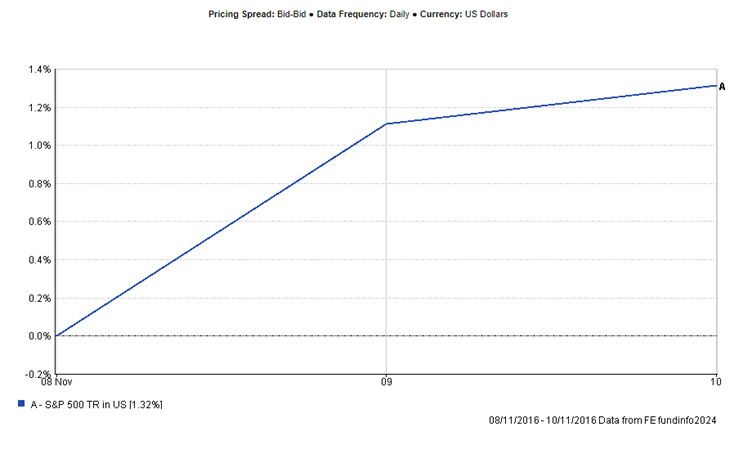

If you leave out the noise in the middle, and pick the open and close prices on those days this is what you’d see:

Source: FE Analytics

A nice steady uneventful rise? Company stocks and indexes fluctuate instantly often driven by the emotions of day traders trying to make money fast, this is not what we are trying to achieve, so do not get distracted by this, it is very easy to do so and our is strategy is not too. Elections happen and they will happen again. At the time the concerns seem very real, who will win and what does that mean for everyone but they soon pass.

At Tideway our portfolio managers are making decisions now for the long term fully aware of the elections and fully in anticipation of the known factors such the view of Biden vs Trump or Sunak vs Starmer.

They expect some volatility, it’s a function of markets, they don’t fear it but embrace it and avoid listening to the noise, so you shouldn’t either.

We are working with them to buy the best companies and investments on a long term basis to provide the outcome we want from our portfolios for you. Markets have always made money over time, as long as you give them time, having a good split in the right areas and avoid the wrong places and never worry too much about the noise.

If you do have any question do feel free to get in contact with myself or your wealth manager who happily answer.

if you want to receive more market updates like this one Sign Up here.