The first thing you will notice is that you do have a new author for your market update this week; I am hoping I can prove to be an able deputy. Don’t worry, James has just taken Friday off, seeing to a family matter and Nick is on holiday, but both will be back.

Thankfully they have left me with a fairly easy gig, the last two weeks in isolation have seen a steady, undramatic rise in the portfolios, exactly what we want. This is a vast contrast to what has been a very tricky and volatile year for almost all investment markets and is giving us some light relief.

Market observers would have noticed sterling is now trading back to August levels (pre-Truss) and each £1 you own now gets you $1.20, yields are tightening and equity indices recovering.

The last couple of weeks have not lacked news content, however. There was a much-anticipated Autumn Statement that I discussed the contents of last week, the markets didn’t flinch despite the doom and gloom of the economic outlook attached to it. Very different to the infamous ‘mini budget’ a few weeks back which sent markets into panic mode.

Other news observers may have noticed the collapse of FTX, two weeks ago. The third largest crypto exchange, a story of a Bahamian based exchange platform finding a huge hole in their balance sheet, we all thought they were just an exchange platform. The crypto market fell dramatically, shedding almost a third overnight putting its future and function as an investment into question, but all other established markets again barely moved.

Both these events I would have assumed would have caused some wider market volatility, especially given the nervousness at the moment. This highlights to me that trying to predict what the markets are doing in the short term is nothing more than educated guessing, highly risky and that staying invested is the best advice we can give our clients.

There is also a lot evidence that missing out on the best days, that can often happen in a recovery, can seriously hinder long term performance.

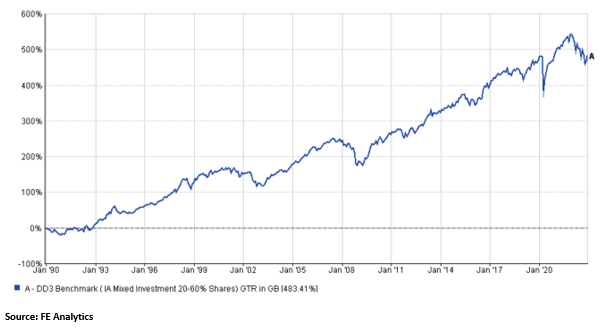

Below is a chart of our DD3 (medium risk) benchmark since outset in January 1990.

On the face of it, this graph has only one trend and that is up, looking closer will see some very famous dips, the dot.com bubble, the covid dip, the great financial crisis and early 90’s recessions.

Over the long term these almost became insignificant but they certainly were not at the time. The benchmark is an average of well diversified portfolios – we of course want to do better than that and the below graph shows that we achieved that since launch in September 2016. Give or take we have doubled the benchmark returns in 6 years, before fees:

A year ago, I would have never predicted what was in store for 2022 but what I did know, was that a well-diversified portfolio in solid assets is a good plan to making investment returns over the medium-long term.

I also knew that market downturns were part and parcel of investing but notoriously hard to predict both in terms of time frame and depth. My view on this has not changed.

Fundamentally our portfolios are designed to make money over the long term and we remain confident they will. The bonds that we buy for clients are in real businesses with consistent revenue streams and have a clear strategy to pay back their bond obligations both at maturity and all their coupons along the way. The equities we hold again are in established business which have customers, management, goals and aspirations all of which can be assessed and forecasted.

We will avoid anything we do not understand or cannot see a clear line to making a return for clients, this is why we never invested in speculative crypto and avoided ultra-low yielding gilts for a long time and, with what has happened in 2022 to both, we have made good calls.

Short term market movements only show current sale prices, which at the moment are suppressed; of more importance is forward looking returns. James and Nick have discussed this in previous recent market updates.

What we want to do at Tideway is buy the “best-in-class” fund managers in a well-diversified portfolio with clear forward-looking returns without taking any undue risks.

What I can’t tell you is what the rest of 2022 will look like, nor what 2023 will look like. I also can’t tell you when inflation will get under control or who will win the football world cup. However, I can tell you that we are invested in a solid strategy designed to make money, with a high level of diversity, managed by the best fund managers in their field. They are investing in the best businesses globally in the right asset classes that will get through economic downturns such as what we are seeing in 2022 and have done in the past.

I hope this market update has been useful for you and if you have any question do feel free to get in touch.

- The content of this document is for information purposes only and should not be construed as financial advice

- Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise

- We always recommend that you seek professional regulated financial advice before investing

- Any references to forward-looking yields does not represent the future performance of the portfolio and should not be taken as an indicator of potential performance