It has been a volatile four weeks in investment markets which began with positive news as UK’s June headline Consumer Price Index inflation figure came in lower than forecasted (7.9% versus 8.2%) fostering optimism among market participants that the Bank of England’s interest rate hiking cycle might be nearing its conclusion thereby providing relief to an economy thought to be struggling under the pressure of higher borrowing costs. This was of course welcome news to which markets responded very strongly.

Unfortunately, this optimism did not last long with subsequent economic data out of the US, UK and China bringing investors back down to earth. In the US, despite a smaller than expected pickup in headline inflation, core inflation has remained higher than the Federal Reserve would like. This combined with the fact that US July Retail sales also came in higher than expected effectively ensured that the Federal Reserve will now likely keep rates higher for longer.

Returning to the situation in the UK, despite the positive unexpected turn in headline inflation during June, the corresponding figure for July, while lower at 6.8%, exceeded the market’s consensus forecast of 6.7%. Additionally, both core and service inflation indicators surpassed expectations, coming in at 6.9% and 7.4% respectively.

Juan Valenzuela, co-manager of the Artemis Target Return Fund and a key member of Artemis’s fixed income team, which constitutes a fundamental component of Tideway’s fixed income and multi-asset portfolios, holds the belief that the Bank of England (BOE) will find itself compelled to react to this data. He anticipates a probable 25 basis point increase in September, a perspective shared by our macro advisors, TS Lombard whilst not completely ruling out a 50-basis point increase. Juan further notes that there is one more employment report and inflation print before the BOE’s next decision on 21st September.

To add to the higher rates for longer narrative in both the US and the UK, weak Chinese economic data have also contributed to recent market volatility.

Fixed Income Positioning:

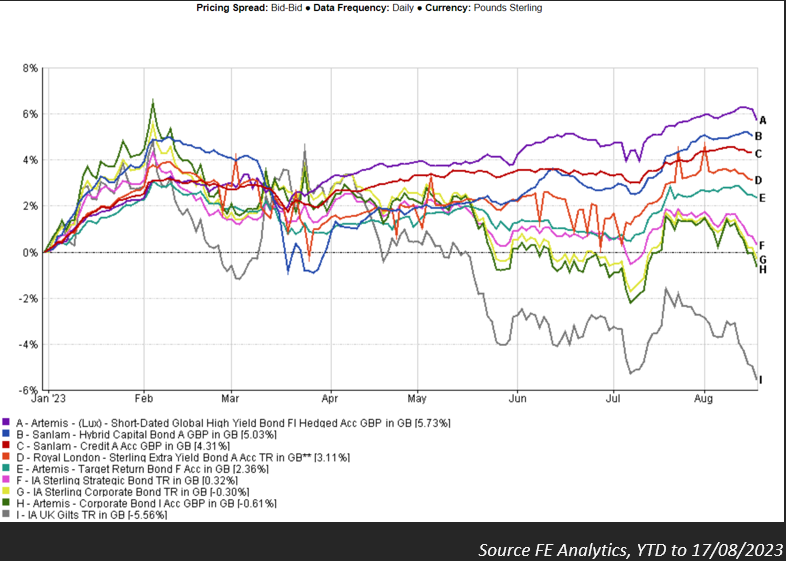

As an interest rate sensitive asset class, fixed income returns have been volatile as a result of the most recent inflation figures and the higher for longer interest rate narrative communicated by Central Banks. Fixed income sectors such as Investment Association (IA) UK Gilts and IA Sterling Corporate Bond, which are typically the most interest rate sensitive due to their duration, being the most heavily affected having returned -5.56% and -0.61% respectively year to date. Even the IA Sterling Strategic Bond sector, which gives fixed income managers ample discretion over both duration positioning and credit quality has fared only a little better with the average strategy returning 0.32% over the same period.

Although Tideway, along with the rest of the market, certainly did not envision interest rates, and future projected interest rates being where they currently are (base rates are currently at 5.25% with projected peak rates of 6% – 70bp total increase over the next three meetings) due to the pressure this would put on the UK economy, the fixed income book has been well positioned for rising rates.

As perhaps the most heavily discussed topic of Tideway’s Investment Committees over the last eighteen months, the team have resisted the temptation of being greedy and refrained from extending duration, keeping the majority of our fixed income exposure at the short end of the curve taking advantage of the high yields on offer. As you will see from the graph below, this has translated into strong returns relative to the aforementioned Investment Association sectors.

Chart 2: As a sidenote is possible to see the correlation of performance of the IA Gilts sector with Inflation prints and BOE correspondence. Performance rebounded off July lows of c.-5% to c.-2% as the market digested the better-than-expected June UK inflation print only to retrace as July CPI numbers underwhelmed. Although still correlated, Tideway fixed income selections have exhibited much lower correlation to interest rates and therefore endured lower volatility.

The protection provided by keeping duration short in a rising rate environment becomes apparent when examining the £ Short Dated Investment Corporate Bonds universe. As of the end of June 2023, this universe boasted an average yield of 7% combined with an average duration of just 1.83.

As a reminder duration is a measure of interest rates sensitivity; should interest rates rise by 1% over what is currently being priced, in simple terms would stand to lose 1.83%. Combining this with a running yield of 7%, interest rates would have to rise by another 3.83% for these securities not to make money on a one-year basis (for ease of comparison this assumes no deterioration of individual credits or the creditworthiness of the market as a whole). This is known as the breakeven yield and highlights the magnitude of the opportunity we think is currently on offer.

For comparison, and to illustrate how far markets have come over the last two years, the yield on £ Short Dated Investment Corporate Bonds in January 2021 was just 0.63% with an almost identical duration figure of 1.86.

To compare the breakeven yield on the index at this point was just 0.34%. Staying short duration however is not without its risks, as should yields fall from here whether from better-than-expected future inflation numbers or a recession forcing central banks to cut rates, we would stand to lose out in relative terms versus those who have a higher interest rate sensitivity (longer duration). With Central Banks reiterating their message of higher rates for longer we remain very comfortable with our positioning for the time being.

While Tideway’s Investment Committee have gotten the duration call correct so far, Tideway’s fund managers also deserve recognition performing well relative to the broader market. Our core holdings in both Sanlam Credit Fund (+4.31% YTD) and Sanlam Hybrid Capital (+5.03% YTD) have enjoyed a particularly strong 2023 with both funds managing risk well, picking strong performing Credit securities, and taking advantage of the high yields on offer in the fixed universe. Artemis Short Dated Global High Yield has been our best performer returning 5.73% year to date. Our weakest pure fixed income play has been Artemis Corporate Bond (-0.61% YTD) reflecting the interest rate sensitivity of the Investment Grade Corporate Bond universe.

| Fund | Yield to Worst | Sector Qartile YTD** |

| Artemis Corporate Bond | 6.54% | 3 |

| Artemis Short Dated Global High Yield | 8.14% | 1 |

| Artemis Target Return | 6.83% | 1 |

| Royal London Short Duration Credit | 7.69% | 1 |

| Royal London Sterling Extra Yield | 7.86% | 1 |

| Sanlam Credit | 6.99% | 1 |

| Sanlam Hybrid Capital | 9.10% | 1 |

| Vontabel Emerging Market Corporate | 8.47% | 4 |

*Yield to Worst (YTW):

Imagine you lend money to someone, and in return, they promise to pay you back with some interest. But there are a few ways they could end up paying you back earlier than expected or under different conditions. “Yield to Worst” is like looking at all those possible scenarios and figuring out which one would give you the least amount of money in return. It’s a way to be cautious and think, “What’s the least I can expect to earn from this?”

** The quartile rankings indicate the relative performance of each fund within its Investment Association sector, with 1 being top quartile (best performance) and 4 being bottom quartile (worst performance). Of perhaps greater significance it should be pointed out that the portfolio above, after the most recent inflation print, now yields in excess of inflation, something that cannot be said for cash.

To stay up to date with the markets, you can sign up to receive our biweekly market update here.

- The content of this document is for information purposes only and should not be construed as financial advice

- Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise

- We always recommend that you seek professional regulated financial advice before investing