Reporting from Tideway’s Greek headquarters with a 2 hour headstart on the London office I had no trouble meeting the publishing deadline in London today.

Before talking money this week a few shout-outs to staff members. Congratulations to Will Bale and his growing family, whose second child, Jacob, arrived yesterday.

Older members of the team have been adventuring. Our consultant and ex-olympic sailor Marshall King completed a gruelling 600nm Fastnet race finishing 57th with 450 boats entering and 100 not making it through the first 24hrs. Less wet and windy, Ursula Baxter got us safely from Barnes to Crete without flying. Nine trains, two ferries, one bus and a cheeky taxi – think of all those tickets! It only took four days, and great fun too, with enjoyable meals and stopovers in Paris and Milan. Who knew the Italian ‘Frecciarossa’ trains could cruise at 300kph.

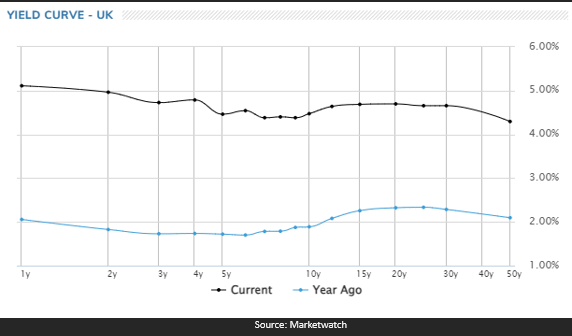

The Bank of England raised base rates again yesterday to 5.25%, but could that be the last? 2 year Gilt yields fell 0.5% to around 5% after the July inflation figure and stayed at that level. This has allowed our fixed income funds to make decent returns since mid-July. Longer duration rates have been on the rise again. We have stayed away from long duration bonds, which has been a good move so far, but may start to add extra duration into portfolios as rates settle. The yield curve is flattening off as we predicted, we expect the short end (left side on the chart below) to fall as inflation lowers, to get back to a more normalised curve which should rise up left to right.

This chart is a good reminder that we are still less than 12 months in to the big correction, with the maximum rate on offer from Gilts this time last year under 2.5%.

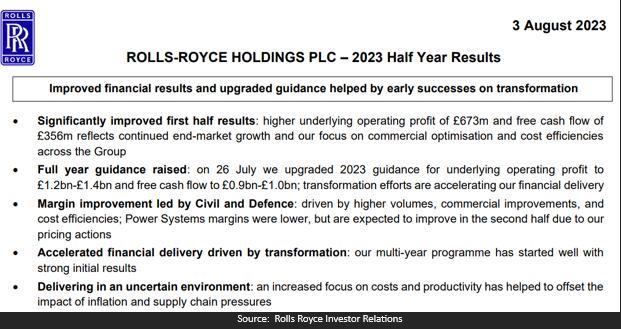

July saw Q2 earnings results and it is good to remind ourselves that underpinning all our equity fund returns are the earnings of individual companies, some of whom we are all pretty familiar with and using on a daily basis. Two caught my attention back in London, the juggernaut that is Microsoft and a great British company Rolls Royce. Both are doing very nicely. Microsoft shares are up a whopping 36% year to date and Rolls Royce shares have almost doubled.

Microsoft Earnings Quarter Ending June 2023

Rolls Royce Half Year Report August 2023

Schroders Global Equity Income

This is one of our most actively selected funds where the holdings are most differentiated from the MSCI world index, with Schroders looking to invest in undervalued companies paying sustainable and increasing dividends. To highlight this the average value of the shares in the underlying companies was last reported at just 10.8 times earnings (source: Schroders most recent fund fact sheet). By comparison the shares in the companies represented by the MSCI World index are valued at 20.8 times earnings (Source: MSCI Index fact sheet July 2023).

According to the most recent factsheet the top three holdings are:

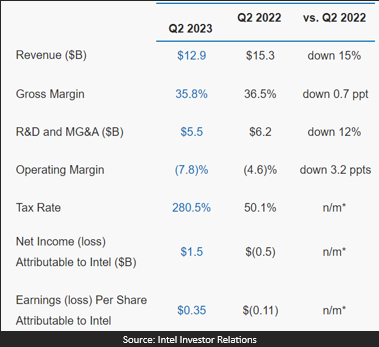

1. Semi-conductor manufacturer Intel whose profits rose to $1.5bn for the quarter from a $0.5bn loss in the same quarter of 2022. Intel currently operates in a falling market of PC sales but is executing a turn around with US state backing to regain a leadership position in chip manufacturing.

2. German Trye manufacture Continental (and sponsor of England Rugby!) are yet to report Q2 earnings but reported very positive Q1 earnings with net income up c60%

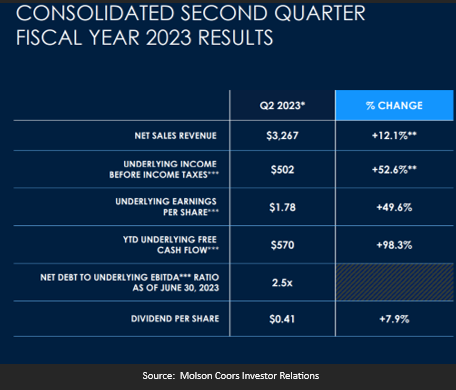

3. Brewer Molson Coors increased income by c50%, is less well known in the UK but who own both Carling Black Label and Aspall Cider, huge of course in the US and Canada with Coors Light and Molson Canadian.

Dundas Partners Heriot Global

This is our ‘quality growth’ fund looking to invest in market leading businesses with increasing earnings and dividends. Its top three holdings are:

- Software business Microsoft, which we have already looked at.

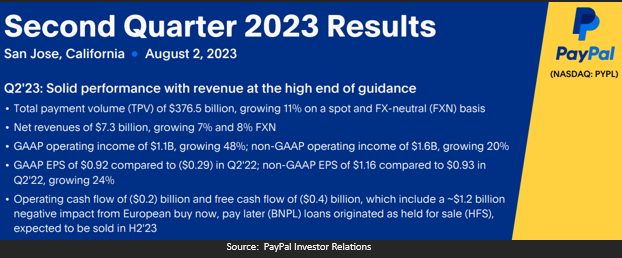

- Online payment transactions business PayPal with its massive online presence delivered a 48% increase in earnings.

3. Dutch Semiconductor manufacturer ASML and supplier to Nvidia of ultra high-end chips for use in AI applications sees a 30% growth in its revenues.

Whilst it is clear some businesses will be suffering higher costs and falling margins it’s also clear our active fund managers are finding great businesses with growing earnings.

These results bode well for a continuation in the recovery of our portfolio values over the rest of the year.