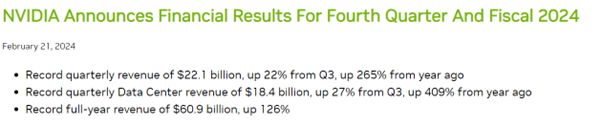

The big story this week was Nvidia’s earnings. Every now and then one company’s progress seems to encapsulate the zeitgeist and sets the mood of the wider investment market. This week it was the turn of Nvidia.

Nvidia did not disappoint.

Source: Nvidia

These are staggering revenue increases, but the real juice is in the Nvidia’s profits.

“For fiscal 2024, revenue was up 126% to $60.9 billion. GAAP earnings per diluted share was $11.93, up 586% from a year ago. Non-GAAP earnings per diluted share was $12.96, up 288% from a year ago.”

This company has increased its profits by roughly 4 fold in a year. How on earth?

Nvidia sells high end Central Processing Units (CPUs), it does not make them, that’s done in Taiwan, but their H100 CPU retails for around $30,000. It is selling more than a million of them every year and demand is increasing. The biggest buyer out there is Meta closely followed by Microsoft as these firms push the boundaries in artificial intelligence. It is also selling them to Google, Amazon, Oracle and Tencent, not a bad customer base!

The good news for Nvidia is that according to a Barrons stock analyst, one of these H100 CPUs costs just $3,320 to make, giving Nvidia a gross profit margin of over 70% and net profit margins of over 50%. Compare this to poor old Elon’s Tesla. Telsa sold almost 2 million cars last year and hopes are up that Tesla will be able to make a car for a retail price of c$30,000 to widen its market share. Tesla won’t be achieving this with the new Cybertruck and there is a lot of competition. Nor will Elon have a 70% gross profit margin! Tesla is fighting hard to maintain a net profit margin above 15%.

So, whilst Nvidia, at almost $2trillion market cap and now the 3rd most valuable company on the planet, may look insanely expensive at 23 x its current revenue run rate, that is only c 46 X its rapidly growing profits. Suddenly it does not look so expensive. This is absolutely not a 1999 dotcom bubble stock that might make a profit in 10 years’ time, this is a market leading stock, with little competition in a growing market that is already hugely profitable.

The good news for us is that we aren’t the only ones to recognise the differences between 1999 and today and Nvidia, whilst unique and remarkable, highlights a booming tech sector in a resilient global economy. So, a great many stocks rose substantially after this earnings news lifting equity markets around the world.

Most equity markets are now pushing new high-water marks, China, Hong Kong and the UK being the exceptions, and this is feeding into our fund returns, which Nick looks at below.

As a reminder the gains from yesterday’s price rises will not appear in your portal valuations until Monday but as they do you will see most of our portfolios approaching their previous high water marks at the end of 2021. Patience rewarded and more to come we think.

Jakob Fugger

Which leads me to Jakob, or Fugger the Rich, as he was known to his mates. Although reading his biog, I suspect by his later years, he probably did not have many mates left!

Fugger was a German merchant, mining entrepreneur and banker in the late 1400’s early 1500’s. He is arguably the richest man that ever lived. Wikipedia quotes his fortune at its peak to be estimated as $400bn in today’s money and equivalent to 2% of European GDP at the time, noting there was probably no GDP in the US in 1520!

Fugger is credited as the inventor of the balanced portfolio and how to manage it. From his writings he is quoted as saying:

“Divide your fortune into four equal parts: stocks, real estate, bonds and gold coins.”

“Be prepared to lose on one of them most of the time… Whenever performance differences cause a major imbalance, re-balance your fortunes back to the four equal parts.”

At Tideway we manage your portfolios across three of Jakob’s favoured holdings, stocks, bonds and we have a little in real estate. We don’t hold gold coins anymore, but of course we can now make over 5% p.a. and more than inflation in money market funds or cash equivalents.

Using our discretion we do rebalance our mixed asset portfolios. We monitor the underlying components and if our equity holding substantially outperform our bond holdings, we will take profits from equities and add to our bonds. Vice versa if equities fall in value relative to the bond holdings, we will sell bonds and buy equities.

Profit taking and topping up investments in downturns are strong investment disciplines, proven to work.

We also separate out portfolio income from capital. Income as a portion of total returns fell with quantitative easing and ultra-low interest rates. However, after the big rates adjustment in 2022/23 portfolio income is back, thank goodness. Net of fees our portfolios are now generating 3-5% in annual investment income, which is much more stable and reliable than capital values.

Where the process of rebalancing gets more difficult is when you start to draw an income from your portfolio which is larger than the net income we can earn.

Of course, there is nothing wrong with doing this, i.e. spending some of your capital in later years, or SKIing as it is sometimes referred to…..Spending the Kids Inheritance. In today’s higher rates environment, a single life, level annuity will now give you 7% p.a. income guaranteed for life. Of course, to get this you must give up all your capital and accept that as a level income over time this will become less valuable because of inflation.

If you expect to spend less in later years, release capital from property or inherit funds, any one of these might suggest drawing an income at this sort of level from your pension drawdown account could be a sensible plan.

But until now it has presented us with rebalancing challenges as sometimes we get forced to sell investments to fund income withdrawals rather than to follow Jakob’s sound advice. This can lead to us selling investments in downturns such as the one we have just been through from the end of 2021 until now.

Tideway’s Dual Account Drawdown

Having worked with our custody and SIPP providers AJ Bell we are now able to offer ‘Dual Account’ Drawdown. We will be putting more about this on our website shortly and we are publishing a paper and new calculator to help our clients and wealth managers take advantage of Dual Account Drawdown.

In simple terms it will allow us to run two separated portfolios in two separate accounts in one SIPP. One account to store funds to meet your withdrawal needs, invested in low volatile cash plus funds, and one account for your longer-term investments. Your withdrawals can come from the first account and the portfolio income and profits from the second account can be moved across as they arise.

This is a relatively simple development which will help us manage drawdown funds more effectively. It won’t affect everyone in drawdown, but if you are drawing income above the 3-5% level per year from your SIPP, it will help us avoid selling anything in a downturn. It should also help you to think more long term about more volatile but higher rewarding investments in a portion of your SIPP funds where shorter term volatility will be less of an issue.

In short it will help us be a bit more Fugger in how we manage your funds, although I hope we can remain friends whilst we do it!

One day I think all good drawdown accounts will be built this way and we are pleased to be able to offer this well ahead of our competitors. We intend to work through all our drawdown clients in due course to see how the dual account solution can help. In the meantime we will be approaching those of you with the most to gain from the new innovation in the coming weeks.

The benefits of portfolio diversification.

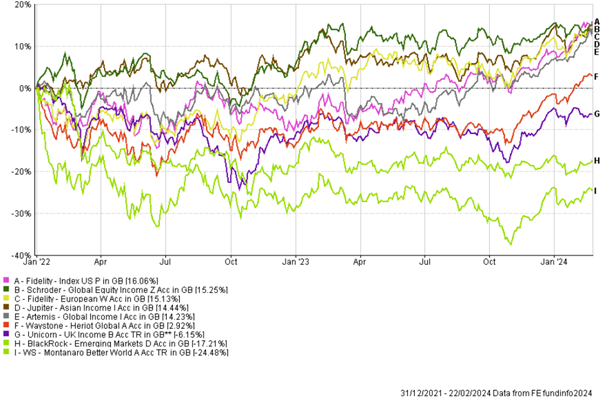

As multi-asset portfolios creep back up on their high watermarks achieved at the end of 2021, we thought it would be useful to show what has performed and what has not, as well as highlighting the benefits of a truly diversified portfolio for those in the de-accumulation phase of their lives. We have not added every single fund to the below charts as this would make the charts much harder to follow – though we have made sure to cover the performance extremes.

Tideway Equity Selections:

Observations from our Equity portfolio:

- Although the US market and the Magnificent Seven have enjoyed a lot of the press, in 2023 and 2024, and rightly so, performance over the whole period has not been nearly as strong as you would think in relative terms due to a tough 2022 which many have now forgotten.

- Furthermore, the US market was more volatile over the period compared to some of our other high conviction selections, particularly Schroder Global Equity Income (now switched to Global Recovery) and Jupiter Asian Income which both had minimal drawdowns in comparison achieving positive returns throughout most of the period.

- Although enduring similar drawdowns to the S&P500, Fidelity European and Artemis Global income have performed very well despite not being able to invest in the leading US stocks.

- The consistency of returns from Jason Pidcock, manager of Jupiter Asian Income, is particularly impressive when you realise that he has suffered only one negative calendar year since he launched the fund in 2018 achieving positive returns in both 2020 fallout of Covid and in the high inflationary period of 2022.

Source FE Analytics 23/02/2024

- Smaller companies: Montanaro Better World and Unicorn UK Income faced headwinds with smaller companies performing poorly across the board. After five years of calendar underperformance versus large caps, and with strong fundamentals and lower relative valuations, we think they will perform very well over the coming years should projected rate cuts materialise.

- Emerging markets – Negative returns driven predominantly by China. We have covered this off at length already this year.

De-accumulation Phase:

- For those building wealth for retirement, the journey is less important with more volatile assets potentially even more welcome for those still contributing money on a monthly basis.

- Those who are withdrawing money on a regular basis do not have the same luxury with the journey mattering a lot more.

- Having a diversified Equity portfolio with funds designed to perform in different environments is particularly important, allowing disinvestments to focus on funds which have performed well rather than selling at losses whenever the broader equity market endures a downturn, Which it always does.

- For example, if you had invested your Equity portfolio solely in US stocks, you would have had no choice where to have withdrawn your money from in 2022 which would have been a less appealing solution than withdrawing from Tideway’s range of funds.

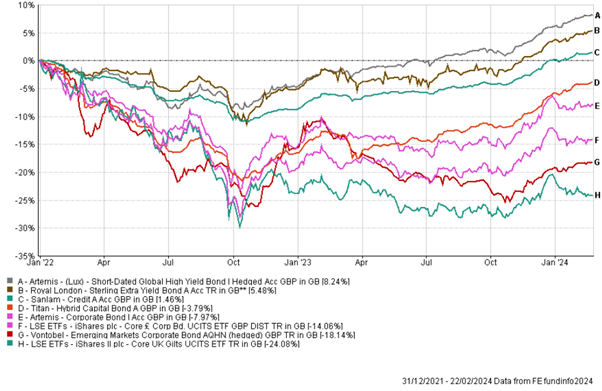

Tideway Fixed Income Selections:

Source: Artemis Funds

Fixed Income observations:

- Once in a generation rate rises meant all fixed income solutions were punished from early 2022, regardless of Credit quality (governments amongst the worst hit), with all future cashflows repriced, as government base rates rose significantly from near zero to current levels to combat inflation.

- Those with less interest rate risk (short-dated funds) therefore performed the best with Artemis Short Dated High Yield recovering all losses by 3rd quarter 2023 whilst Royal London Sterling Extra Yield and Sanlam Credit followed shortly thereafter in Q4. Other short-dated funds, Artemis Target Return and Royal London Short Duration Credit (not on the charts) are also in positively territory returning +4.64% and +2.41% respectively.

- It is important to note that strong Credit selection was also a primary driver of returns for these funds.

Vontobel – Emerging Market Debt, was hit hard, like on the Equity side. We sized this position appropriately however being only a fraction of our total fixed income exposure. - No exposure to longer dated low yielding gilts was something we had deliberately avoided for many years – Even with the yields on longer dated UK government securities now over 4% of the year, should longer term yields remain relatively unchanged (we do not think longer term yields will fall as much as short dated yields in any potentially rate cutting cycle) – then owners of these securities will have to wait many more years yet to get their money back.

- Artemis Corporate Bond and Titan Hybrid Capital are both still in negative territory however containing more interest rates risk than our other selections. However, with higher yields of 5.86% and 8.21% respectively, as well as the lower drawdown than governments, you can calculate that any timeframe for return of capital should be much shorter.

Active security selection was also very important for Artemis Corporate Bond – outperforming the iShares Investment Grade passive equivalent by roughly six percent. - As we explained throughout 2022, we were confident that our fixed income selections would pull through as managers benefited from higher yields now available in the market (yields on our Credit managers between 5.5% and 8.25%) With most money recovered, clients can now benefit from the higher real and nominal yields on offer.

- The content of this document is for information purposes only and should not be construed as financial advice.

- Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

- We always recommend that you seek professional regulated financial advice before investing.