James Baxter, Founder

US AI chip designer Nvidia’s valuation has exploded upwards again. It has almost doubled in value since the start of the year and is close to overtaking Apple in value. Apple is down in value year to date as are Tesla and Google.

Less the Magnificent Seven, rather the Lone Ranger!

Nvidia is dragging with it the S&P 500 index and of the 8.5% made by the index this year in $’s (in £’s it’s a bit less), a whopping one third of that gain is down to this single company’s share price rise, bearing in mind there are 500 companies in this index!

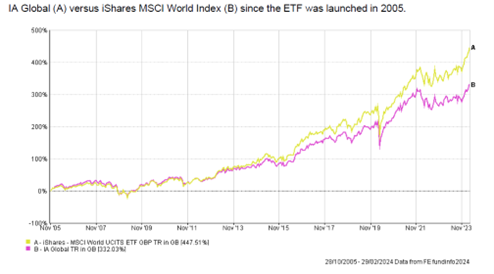

The success of US indices in recent years (it wasn’t always like this) is fuelling the debate on index tracking as more and more investors around the world give up on active managers and track the World or US index. It does not really matter which one anymore as US equities now make up almost 70% of the MSCI world index.

So where is Tideway on this debate?

1. No Case for Index Tracking in Fixed Income

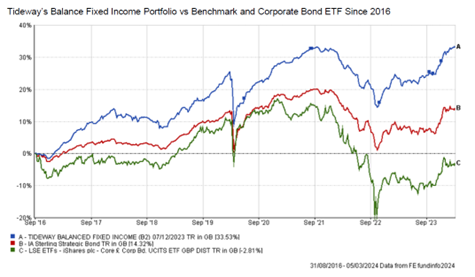

The chart below shows our Balanced Fixed Income portfolio (blue) since we launched it versus our peer group (red) and one of the most popular UK Corporate Bond index funds run by BlackRock (green).

Yes, investors could have saved maybe c£1,000 per year in fees by taking no advice and buying £100,000 worth of this corporate bond index fund in September 2016 on an execution only low cost platform. They would be £30,000 worse off today as compared to a Tideway Balanced Fixed Income investor after all fees.

This is not just a fluke, we know why this has happened and why it will happen again.

Fixed income markets just aren’t as efficient as equity markets and the fixed income indices are somewhat flawed in their construction. Not least, whilst it may make some sense to invest in the shares of the largest companies, it is not so smart to buy the bonds of the companies with the most bonds in issue i.e. those companies with the biggest debts!

We won’t be buying passive fixed income funds anytime soon and we are saddened to see so many investors clamouring to buy Vanguards ‘Lifestyle’ funds which invest passively in fixed income as well as equities.

There is £4.7bn in BlackRock’s iShares corporate fund (shown in the chart above) and there is £7.5bn in Vanguards two most cautious Lifestyle funds with less than 50% in equities, both of which are below average performance against their peers over the last 5 years according to FE Trustnet, despite their very low fees. It won’t be the equity portion that is letting them down, it’s the fixed income portion of their funds.

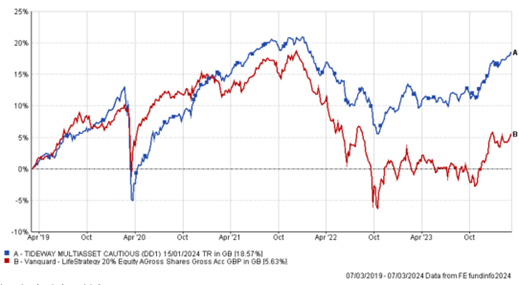

2. Some Passive Equities, But We Won’t Bet the Ranch!

In equities the argument is less clear. The chart below shows active mangers failing to keep up with the World index which has accelerated with Nvidia’s recent performance.

Again, we know why this is happening. It is a function of the continued digitisation of the world dominated by a few US mega cap companies. Plus, it’s the positive feedback loop of index tracking.

As more and more investors capitulate and invest in the index more money pours blindly into the biggest companies shares without reference to the company’s valuation or underlying trading performance.

We are happy to have some of our equity funds invested passively, we hold the S&P 500 and may increase our holding if a good opportunity to invest arises.

But setting the cost of investing to one side, does it look sensible just to track the world index? We want some exposure to these big mega cap companies, but we don’t think it makes sense to invest solely in them for two clear reasons:

- Capital preservation – as individual holdings exceed 3% of any fund you are starting to break the basic rules of stock specific diversification. Don’t hold all your eggs in one basket. This gets more important as the value of companies rise relative to their earnings as is happening with these mega caps. Microsoft at 7% of the S&P 500 index, according to Yahoo Finance, is valued at almost 40 times earnings, it was valued at 25 times earnings as recently as 2022, representing a 30% downside risk.

By investing actively outside of the index we can look through our portfolios to ensure we are not getting too exposed to the risks of any one company. This should give us better capital preservation in a market downturn.

- Performance – back to the positive feedback loop of index tracking. We are seeing the value of mega cap companies being pushed higher than those of smaller and mid size business, which now get precious little exposure to index investors. This is not the norm. It is usually much easier for smaller companies to grow their profits exponentially than it is for very big companies down to sheer scale. If this abnormality reverses, we will get better returns from small and mid-cap companies than from the world index.

So, we will continue to allocate to the best active managers we can find who (1) look for companies with consistent long-term profit and dividend increases, (2) recovering companies that are under valued and (3) mid cap and smaller companies. In all cases, and save for in the last few years, returns from these strategies have been greater than from investing in the world index.

We know this gives us better diversification than simply investing everything in the index and we think at some point it will give us better returns than the index

3. Cost and Value and St James’s Place (SJP)

SJP were in the news again last week after they revealed a £426m reserve (it’s about one year’s profits) for compensation. They have hired c.90 additional complaint handlers, and it is reported they have 15,000 complaints about their ongoing fees.

Last year they signalled a drop in their annual contract fees, then announced a removal of their archaic and unpopular exit fees, now clients are complaining that they have not been getting the ongoing advice they are paying for and SJP appear to have little evidence to defend such claims. The FCA’s new Consumer Duty focuses all businesses on costs and value for money and we know that the FCA have initially focussed on the costs and charges of the 20 largest firms; SJP being one of them.

Whilst Nvidia has tripled its value in the last 27 months, SJP has destroyed 70% of its shareholders capital. A FTSE 100 business worth almost £10bn is now worth less than £3bn and is heading to drop out of the FTSE 100.

Should SJPs customers be concerned?

If they are worried about their savings being at risk, they don’t need to panic, the company’s share price fall won’t impact their accounts.

However, SJP have publicly announced that they will be investing more into passive funds, so this means that clients are likely to have more risk in their equity holdings and under performance in their fixed income as described above. Nor will SJP pass on the cost savings of not using fund managers to its end clients, who are not going to see a price drop in their fees over and above what has already been announced.

If customers are concerned about the costs of their investment arrangements, the advice they are getting from their SJP partner, or whether they can trust that partners advice or the firm’s actions in general, the recent press articles about SJP would not have helped allay those concerns.

Whilst SJP calls itself a wealth manager, it is really an insurance company and sales operation at heart. Its business is persuading people to save money into SJP contracts, and they have been very good at it.

Based on costs and fees we have seen, saving with SJP could cost roughly 5 times the cost of saving with Vanguard. That’s a high cost to have someone persuade you to save more!

For those looking for some help and advice on how to protect what they have saved and create an income, noting Vanguard pulled out of giving advice in the UK in 2023, SJP may look like quite good value but the firms’ products and its sales agents, sorry advisers, let’s just call them partners, don’t appear to be all well equipped to consistently deliver that service.

We are seeing a steady inflow of clients from SJP moving to Tideway. In common they don’t know what costs they are paying, don’t have a tax efficient and thought through plan for creating their income and often hold too much equity risk based on what they need their funds to do.

Someone with £750,000 of investments will pay SJP around £14,000 a year based on their current fees. SJP are saying this will come down to around £12,000 in 2025.

For the same investment amount, a Tideway customer will pay around £11,600 this year and we expect that to come down to around £11,200 next year as we are seeing our third party fund manager fees reduce, which gets passed straight through to our clients.

Fees are notoriously difficult to work out in our industry and most firms’ websites are not explicit about what customers will pay. I did manage to work it out on Brewin Dolphin’s website which for the same £750,000 of investments, with some active management and advice came out at £18,200 each year. I’ll let you judge whether that looks like good value for money!

If you know people approaching retirement or are in retirement investing with SJP, Vanguard or Brewin Dolphin (combined they have about 1.5 million clients in the UK) we would be delighted to hear from them, the improved value for money they will get should be meaningful to them.

Nick Gait, Investment Director

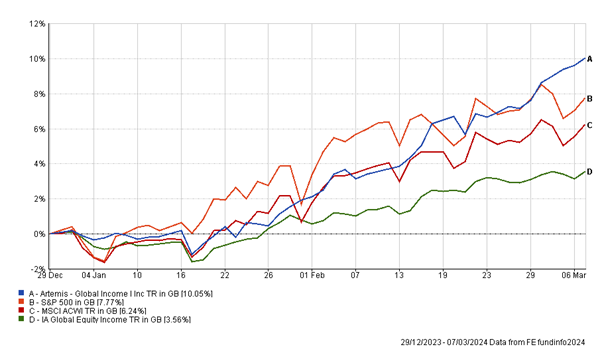

Fund in Focus: Artemis Global Income – 'Not looking for the usual suspects'.

Some of you will be familiar with Artemis Global Income fund after Josh Passmore, an Investment Director at Artemis, presented the fund to Tideway clients on the fund at the Royal Thames Yacht Club in London last year. There will be similar opportunities to hear from Tideway and their fund managers in 2024: All information is available on our website on our events calendar page, please do not hesitate to get in contact with your wealth manager if you have any questions.

For those less acquainted with the strategy, Artemis Global Income, run by the experienced duo of Jacob de Tusch-Lec and James Davidson, invests in companies globally which they believe have the potential for generating high levels of free-cashflow (the money a company has left over after paying its expenses) and for their ability to return cash to shareholders. This is combined with a strong top-down macro view to ensure they are in the best opportunities globally.

Due to their income mandate, they are prevented from investing in US large Cap tech, including the Magnificent Seven, which typically do not pay meaningful dividends relative to their share price. Even in the dividend space they do not look for the ‘usual suspects’ and search for companies which are undervalued and not typically heavily owned by the peer group. The yield on the portfolio is in the region of 4% with the manager looking to add to total returns through the growing of this dividend and potential for share price increases of these low valuation companies.

Leverage has been a specific focus of the manager, believing value can quickly be destroyed with higher rates of borrowing feeding through to companies and is one of the primary measures of identifying value traps.

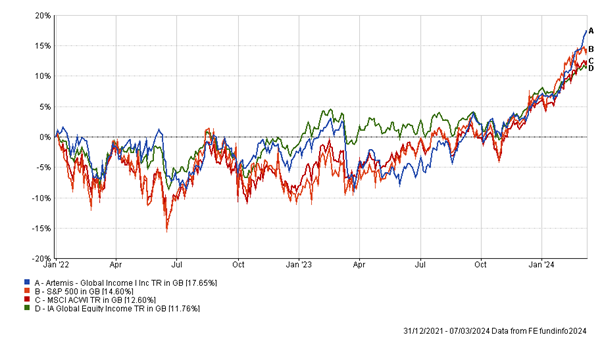

We all know that returns have been dominated and driven by a handful of the US’s top companies over the last 18 months, most notably Nvidia as James has mentioned in his piece above, which also have by far the largest weightings in global benchmarks. Despite the fund not being able to hold any of the top tech performers the fund has outperformed both the S&P500 and MSCI All Countries World Index (ACWI) so far in 2024 and has also outperformed every single member (55 total) of the IA Global Equity Income peer group.

It is always important to note that past performance is not a guide to future returns. All fund managers undergo periods of poor performance in relative terms, especially when their style or mandate is not in favour. It just so happens that the manager has managed to overcome these headwinds as of late with some excellent stock selection and country allocations. Artemis Global Income has also endured leaner times and is a reminder why we continue to back managers should we believe in their investment philosophy and process. Selling poor performers and buying strong performers does not always work.

For some colour on how these returns have been achieved so far in 2024, see below comments directly from the fund manager which was written for performance up until the end of January. Underlined text has been added by Tideway.

Contributors:

Our holdings in the defence sector were the top contributors in January. Shares in Germany’s Rheinmetall and Japan’s Mitsubishi Heavy Industries rose by 11% and 16% respectively (both over 40% in 2024 as of 8th March). In part, this was a response to the ongoing war in Ukraine and the conflict engulfing the Middle East. Governments worldwide are starting to address significant shortfalls in defence spending.

Detractors:

The shares of US commodity business Archer Daniels Midland (down 23%) were weak throughout 2023 given falling commodity prices, and the shares sank in January in the wake of an accounting probe into its nutrition division. ADM is a dividend aristocrat, having grown its dividend per share every year for several decades. Given the nutrition business accounted for less than 10% of group revenues in 2022, we believe the decline in market value to be too large relative to even a ‘worst case’ scenario. Nevertheless, we will be watching how the situation develops closely and continue to assess our investment case.

The shares of American energy company Baker Hughes (-17%) fell in the wake of the potential US moratorium on new LNG (Liquid Natural Gas) export projects and cuts in projected capital expenditure from Saudi Aramco. Given the swathe of LNG facilities planned in America, the effects of the ban could be significant, and the shares of many energy services companies sold off in January. We are meeting with Baker Hughes in the coming weeks to dig into the possible implications of this potential policy.

Activity/positioning:

Our positioning did not change considerably over the month. We continue to find plenty of attractive investment ideas in Japan. Here, we can find companies whose share prices appear modest relative to their underlying profits and which often have little or no debt. After a long deflationary slump, Japan is one of the only regions in the world to benefit from rising prices. We would also observe that corporate reforms preached by the Japanese authorities continue to gather momentum. As a percentage of market value, share buybacks in Japan (where companies buy back and retire their shares to increase future earnings that will accrue to the shares that remain) are higher in Japan than in the US.

Our allocation to ‘core income’ remains at its lowest level since the fund’s inception. Many core income stocks have arrived at a world of higher interest rates carrying too much leverage, which we fear could, in some instances, put their dividends in danger.

In a world where interest rates seem likely to remain higher than they were for most of the last decade, the definition of an income stock is up for debate. Many of the traditional income sectors (such as tobacco, consumer staples, real estate and infrastructure) underperformed the wider market significantly at certain points in 2023 due to their heavy debt levels. As a result, we are thinking more outside the box than ever – at the ‘unusual suspects’. As a result, the Artemis Global Income Fund remains truly differentiated. Our analysis indicates the average commonality between our fund’s holdings and those of its largest competitors in the IA Global Equity Income peer group is just 7%.