Whilst discussing finances within families can be difficult, rising asset prices and frozen Inheritance Tax (IHT) thresholds has inevitably meant that more and more people will be dragged into paying IHT upon their death.

With it being the season of gifting, perhaps now would be a good time to consider and put in place a financial plan which can reduce your liability moving forwards – via gifting.

If you are leaving your estate to your spouse or civil partner, then this transaction is exempt from Inheritance Tax regardless of the amount.

Each UK individual has an inheritance nil rate tax band of £325,000. This means that you can leave an estate of up to this amount to others, on your death, without the recipient paying any inheritance tax.

Providing your main residence is being left to your direct descendants (e.g. your children or grandchildren), you may also benefit from the Residence Nil Rate Band threshold. This could boost your IHT threshold in which no tax is paid by £175,000 – combined with the nil rate band of £325,000, this brings the total to £500,000 per individual.

Unused allowances are inherited by the surviving spouse or civil partner on death, therefore it is possible for most couples to leave a total estate of up to £1million before your children or grandchildren are liable to pay any inheritance tax. For estates worth in excess of these allowances, the beneficiaries would have a 40% tax liability.

A typical estate might look like John & Lorraine’s below;

John & Lorraine are almost 70 and are in a fortunate position where they have paid off their mortgage on their £1million house. They have modest income needs and most of their income is covered by their state pensions. John has a SIPP with £500,000 which is used to top up their income with. They both have combined cash savings, ISAs and Investments worth £250,000.

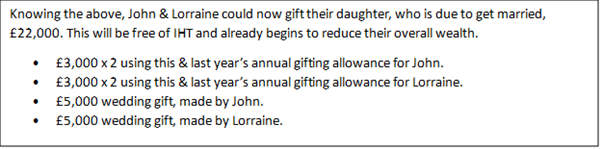

They came to Tideway as they were thinking about passing some of their wealth down the generations. They have three children, one of their daughters is getting married next year, and they also have 3 grandchildren.

What do we know?

- On the first death of either individual, they can pass their whole estate to the surviving spouse without paying any IHT. The surviving spouse will then inherit the unused IHT threshold allowance.

- The house is worth £1million and therefore uses up all of the couples joint IHT-free threshold allowances.

- John’s SIPP is IHT-free as this is held in trust with the pension provider. The £500,000 invested therefore is held outside of his estate.

- The couple therefore have £250,000 above the allowance threshold and their beneficiaries would need to pay 40% tax, totalling £100,000 on the death of the second spouse.

Is there anything that can be done about the tax liability?

- Insure against the tax liability.

By purchasing a life assurance policy, written into trust, you could protect against the sum of the tax liability (£100,000 as per the case study) meaning that your beneficiaries can use the sum assured to pay any IHT bill on your death. This is a legal arrangement that passes the ownership of your policy to the specific beneficiaries and therefore no longer counts as part of your estate. Depending on your health, this could be an expensive option as there will be premiums to be paid. If your circumstances were to change or assets grow in value, there is a chance your beneficiaries may not have enough to cover the full liability. - Make an investment using Business Relief.

You can receive business relief on investments into a business or shares in an unlisted company. Although this option would keep you in control of your money, this can be risky as the investment is made into companies not listed on the stock exchange. This option would therefore be less liquid, which may be a problem in the event of your beneficiaries needing access in the future. - Making outright gifts.

Gifts are time sensitive but there are some allowances & exemptions which can be used to help reduce the tax liability. If the gift is made to one of the beneficiaries of the estate, then making this earlier may be of benefit to them as much as it benefits the donor. Here’s some more information

Below are a few gifting techniques, that if started early enough, could be used to help reduce the overall estate. These are known as exempt transfers and would stand as IHT-free;

- Small gifts – you can make any number of gifts up to the value of £250.

- Annual £3,000 gifting allowance. This can be made to beneficiaries of your choosing and can include unused allowance from the previous year.

- Gifts for education & maintenance. If your children are still in full time education, at university for example, you can make payments towards the child’s maintenance or education costs.

- You are able to make gifts to UK registered charities, political parties or for National Benefit, such as a museum or library.

Gifts on Marriage. As a parent, you can gift your child and their partner up to £5,000 for their wedding. As a grandparent, you can gift the happy couple up to £2,500, or if the individuals getting married are not direct descendants, you can gift up to £1,000. - You can also make gifts out of your disposable income. Providing this is done regularly and does not affect the donor’s usual standard of living. “Regular” doesn’t have to mean weekly or even monthly but must be proved to be on a consistent basis.

If this is something that you wish to learn more about or know someone who could do with financial advice, please get in contact with one of our Wealth Managers or read our Inheritance Tax Guide for more information.