Tideway’s Investment Committee met with our macro analysts TS Lombard yesterday to catch up on what’s been happening and what might happen next. Hot off the press here a few highlights.

Inflation has flatlined in the last 3 months

We did not discuss this yesterday as it was slightly old news from the week before. But in the previous week both the Bank of England and the Federal Reserve paused on further base rate rises.

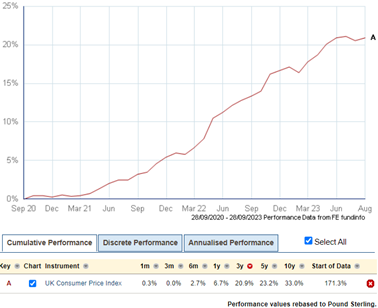

UK Inflation

Although the quoted rate of inflation based on the 12-month increase is still being quoted at over 6%, over the last 3 months prices have stayed flat. This is shown in the table, the rolling 12-month rate of increase is 6.7%, but the rolling 3-month rate of increase is 0.0%.

The chart above plots the index value rather than the rate of change and it is clear that prices have gone sideways since June. This is the main reason for the pause in base rate rises. Of course, only time will tell us if this is a temporary blip in a continuing upward spiral or something more meaningful.

This is good news for mortgage borrowers. I met a mortgage broker last night who said last week he saw that the first sub 5% fixed rate mortgages start to appear. Anyone faced with the decision to go fixed or variable, it may be sensible to consider variable, fixed rates should get more attractive.

So, if inflation is coming down and base interest rates are likely to fall, why did our portfolios and equity markets go down not up after the news?

Well, the fixed income portion of your portfolios did continue to rise, and our pure bond portfolios are very close to year-to-date highs, this time they did not go down with equity prices and have cushioned portfolios against recent equity fund falls.

The Yield Curve Remains Inverted

The Yield Curve Remains Inverted

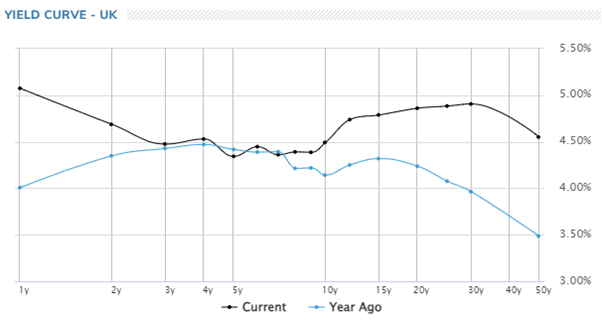

Source: MarketWatch 29/09/2023

We did discuss this at length with TS Lombard and we have looked at this chart a good deal in recent months.

It shows interest rates from base rates on the far left to long duration gilt yields to the right. The picture looks somewhat similar in the US, although the US curve is flatter with higher medium-term rates. It compares the position today with that of a year ago…. just as Liz Truss and Kwasi Kwarteng were about to have their moment in the spotlight.

As the expectation for further base interest rate rises has diminished in the last two weeks, the yield on longer duration Government bonds has increased.

Why is this happening? One explanation which was given in most of the headlines I saw is that investors are now thinking inflation will be more sticky, the recent flat line is probably a blip, and whilst there may not be more base rate rises, base rate cuts will happen less quickly.

This may well be the case and certainly in the US where the economy is stronger, but we don’t think it’s the only reason and TS Lombard agreed.

Two other factors which we are supportive on are:

- Normalisation. We need to remember that on average long duration bond yields have historically been around 5% even when inflation is on target at around 2%p.a. It is quite normal to have long bond yields above base interest rates and above inflation, it was completely abnormal to have them below inflation as we have had for much of the last decade and below base rates as they have been since base rates started to rise.

The yield curve chart above shows there has been some consensus now for a year or so that 3-7 year rates at c4.5% are about right for the economy. But in our view, it shows base rates are now too high and longer duration rates needed to go higher and could still go higher yet. This would be in line with ‘normalisation’ to a more balanced interest rate environment for a stable economy, which we may just be heading towards. - Supply and Demand. The chart and extract below published last month by Statista shows how the US Federal Reserve’s balance sheet expanded through bond buying to depress longer duration interest rates and fight the impact of Covid

The balance sheet was more than doubled. It also shows when quantitative tightening (QT) replaced quantitative easing (QE) in May 2022, now the Fed is selling bonds not buying them, at which point longer duration yields started rising sharply. We should not underestimate the impact of this shift in Bank policy.

Government debt is off the scale in most developed countries after Covid and Central Banks are now shrinking their balance sheets, not expanding them. This is a massive shift in supply and demand for bonds. With less demand and more supply it is inevitable that prices have to go lower and yields have to go up.

TS Lombard thought this adjustment may well now be fully over, we are less sure.

Recession, or No Recession

This is where TS Lombard came up short on a clear prediction, and not surprisingly, there are very mixed messages.

An inverted yield curve, as we still have, and we have had now for a record number of months, has historically signalled a coming recession. But this time could be different. The interest rate situation has been entirely self-induced by Central Banks and could just be the pathway back to normal rates rather than a warning of bad news to come. US consumers are in great shape and have picked up stronger balance sheets thanks to all the QE and now decent pay rises, the jobs market remains strong.

China’s economy looks grim with rising youth unemployment and a creaking housing market, the European outlook dominated by Germany also looks slow. Covid stalled many projects and manufacturing infrastructure is now very old by modern standards. However, companies have strong balance sheets and have been putting off spending and they will have to start spending at some point to remain competitive and this would be good for the economy.

TS Lombard was clear that the risk of a recession is lower than a year ago and further out in time than most commentators thought it would be. They were generally quite positive on equity values for the next 12 -18 months but concerned that a lack of a recession might feed inflation and still higher interest rates which could be negative to equity values.

How Are We Reacting

Firstly, we are long term investors, not hedge fund traders looking for the next quick win (or loss!) so our response will always be measured and more modest. The longer-term outlook for a mixture of bonds and equities looks good, both are significantly cheaper now than 2 years ago and offering better forward return outlooks – more certain in bonds than in equities.

The yield on 20 Year US treasuries nudged 5% p.a. on Thursday, the yields on UK gilts, just 0.1% lower. It was the highest level seen since 2003, 20 years ago. If inflation is coming down to 3% or lower and those rates have peaked this will make for a fantastic risk-free long-term investment delivering real returns. But we need to be careful. If these rates still need to go higher even to say 5.5%, which would still be quite normal, then there will be further capital losses in the short term. We are watching this like a hawk.

The corporate bonds we invest in price off Government bond yields and even in short duration bonds, which is where we are currently focused, we have 7-10% p.a. available now across our bond fund selections and these returns are starting to underpin our portfolio returns and act as a dampener again. This has not been the case in the last couple of years as bonds and equities have tended to move in step with each other leading to higher portfolio volatility.

The S&P 500 which we were lagging has sold off quite a bit in the last week and this may create a good time for us to increase our US equity exposure. The increase in the risk-free return as seen above is dramatic. If there is uncertainty that this is fully priced into bond markets, there is even more uncertainty with equities.

Last week shows how sensitive equity prices are to an increase in longer dated bond yields and without QE, or the ‘Fed put’ as many referred to it, creating liquidity that lifted all asset prices, equity markets will need good earnings prospects looking forwards to support price rises. It is a whole new world as people recognise the renewed cost of money that has been free for so long.

Change of Name and Investment Manager for Tideway selected fund manager:

It has been announced this week that one of our high conviction funds will be changing name and investment manager as part of a new role for its lead manager:

The board of directors has appointed investment manager ‘Titan’ as investment manager of Hybrid Capital Bond Fund, in place of Sanlam Investments UK Limited.

The next statement is taken from the full notice to Shareholders, which is available upon request:

‘The rationale for this change is that Peter Doherty, Head of Fixed Income at Sanlam and lead portfolio manager of the Sub-Fund, is moving to take up a new role as Head of Fixed Income at Titan. As such, in order maintain fund manager continuity, it is proposed to appoint Titan as the investment manager for the Sub-Fund.’

What does this mean for Tideway clients?

- Business as usual: Peter Doherty remains as lead manager and will continue running the strategy to the same mandate when the fund was first setup in 2016.

- Peter will retain full authority over the portfolio – there is no centralised buylist or investment process.

- Back-office processes and marketing will now be performed by Titan employees rather than Sanlam.

- This does not affect any investments in the fund – no investments will need to be sold or repurchased as part of this transfer with none of the associated costs of the move borne by investors.

- Tideway will retain same visibility of holdings and fund monitoring regime currently in place. We will be watching this very closely to make sure the fund stays on mandate.

- As highlighted in the Shareholder Notice, Sanlam Investments UK will remain as investment manager to the Credit Fund and will be managed by their existing fixed income team.

Current Portfolio positioning:

- Tideway continue to have conviction in the Hybrid Capital strategy which has been held in client portfolios for the last seven years.

- Despite a tough 2022 for the Hybrid Capital fund as a result of large rate rises from central banks, the fund has returned 12.7% in the last twelve months from its 2022 low on 13th

- Portfolio yield to worst (excludes potential defaults) of 9.5% with a distribution yield of 7.0% on the income share class. Effective average duration (interest rate risk) of 5.8 years.

- Despite the recovery the fund is still c.12.5% off its high watermark – with the healthy yield it is not difficult to see the potential for a relatively short recovery period, especially compared to long date government bonds which were the fixed income security of choice for many investment managers prior to record interest rate rises. We are expecting a new high water mark for this fund within 2-3 years, where as with government bonds recovery could take 5-7 years.

- Familiar names in top ten holdings: Aviva, Electricite de France (EDF), Investec, British Telecommunications, Sainsburys Bank, Rothesay Life

About Titan Wealth:

- Titan Group was created to provide a whole-of-market suite of products to retail clients for IFAs and HNWs through acquisition, development of technology and ownership of investment funds.

- Assets Under Management/ Assets Under Administration of over £10bn.

- Titan Group Companies include Global Prime Partners, Ravenscroft UK and Square Mile research.