This week a quick look at two certainties in life and their impact on financial planning.

Annuities

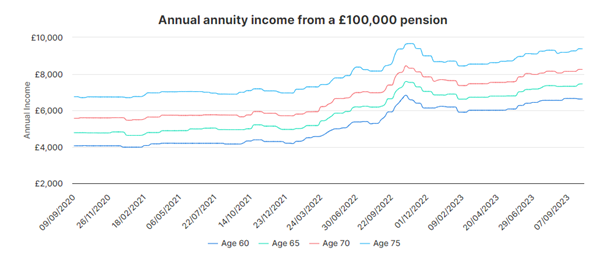

Annuities are back in the financial news as the income they produce has rocketed over the last two years driven up by the rise in gilt yields.

Source: Hargreaves Lansdown 13th October 2023

This is the silver lining for all those living off their invested capital whether it’s invested in, or outside a pension fund. Annuity rates tell us the guaranteed lifetime income that we can buy with a capital sum and as the chart above shows this has increased by approximately 60% since the end of 2021. So, although our invested capital might be lower, our future income prospects have risen significantly.

A £500,000 pension pot for a 60-year-old would have produced around £21,000p.a. in level lifetime income at the end of 2021. If the same pot is down 10% from the end of 2021 high and is worth £450,000 today it can now generate around £30,000p.a., a net gain of 43%.

So, should we all rush out and buy an annuity? Not unless you are completely fed up with dealing with us or any other financial adviser! Whilst they take away all responsibility and most of the risks of creating an income for life, an annuity remains an expensive product and the cost of insuring against the certainty of dying remains high. However we can reap the benefit of the increase in lifetime income by staying invested.

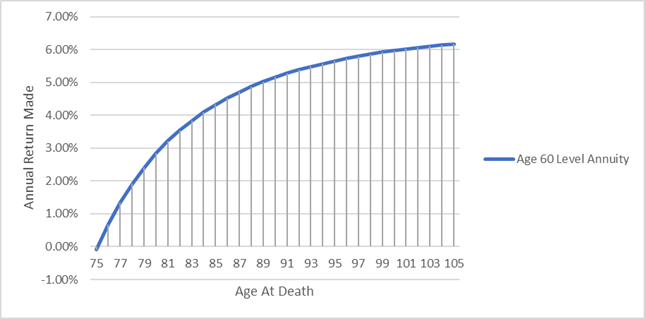

Those who completed DB transfers with us will recall a similar chart to the one below in their transfer report. It highlights the return made on the annuity example above depending on the age you die.

Returns Offered by Current Annuity Rates

Source: Tideway Wealth

This tells us that you would have to live at least 15 years and beyond age 75 on this annuity to make any money at all from current annuity rates. You would need to live beyond 90 to beat the guaranteed risk-free long-term return now offered on gilts and beyond 100 to beat the forecast return net of fees on our entry level cash plus fixed income portfolio.

We reviewed this, our lowest risk portfolio, yesterday with the investment team. It is invested primarily in short dated corporate bonds and with recent interest rate hikes we can now add in short dated gilts and money market funds to lower risk even further. It will still have a net of all Tideway fees return expectation of 6% per year.

Whilst this 6% return is not guaranteed to last for ever, broadly speaking you have to give up your capital, lock in an irreversible rate of income for life and live to over 100 to be better off with an annuity than investing with us in our lowest risk portfolio. Of course, for those prepared to accept a bit more risk and volatility the long term returns from our higher risk bond funds and mixed asset portfolios, should now be higher than 6% p.a. net of all fees.

Taxes and Bernie Ecclestone

I don’t often read the Evening Standard, but one headline caught my eye yesterday. Earlier in the day, Bernie 92, had pleaded guilty to tax fraud and lying to HMRC in 2015 and received a suspended prison sentence. This was no big surprise given the way in which Bernie has lived, but the £653 million settlement did raise an eyebrow! If the internet is to be believed, Bernie has a net worth of c$2.9bn so has just agreed to pay c30% of his money to HMRC.

Put another way, Warren Buffet used to brag that his company Berkshire Hathaway now worth $750bn paid 100% of the US tax bill for one day each year. On the same scale Bernie alone has just agreed to pay the entire UK’s tax bill for three and a half hours! Although I doubt he will be repeating the gesture! It would have been great to be a fly on the wall when that was negotiated with HMRC, we will never know who had the last laugh. If it achieved exclusion from IHT for a large portion of his net worth it may have been Bernie and his family.

The bad news is that whichever party is in Government, for the foreseeable future the UK’s tax bill will have to rise. If you want to see the impact of rising interest rates on mortgage borrowers look no further than the UK tax payer. I’m no economist but just looking at levels of debt servicing costs and tax receipts the UK interest bill will be jumping from around 6% of tax receipts in 2022 to 16% of those receipts as its funding rolls over and moves to higher rates. That’s before you look at the cost of Social Security and running the NHS which will likely remain the biggest costs. I am sure those tax receipts will be expected to rise with inflation, it might not be a train crash.

But it’s clear any UK Chancellor and Prime Minister are going to have to tread carefully around cutting taxes to avoid a Liz Truss style humiliation in the bond markets.

The good news is that there are plenty of perfectly legitimate ways to reduce the tax take on your investment returns. To name just a few;

- Tax efficient gilts as an alternative to taxed deposit accounts

- Higher pension allowances and the abolishment of the Lifetime Allowance charge

- ISAs and offshore investment bonds to avoid or defer taxes

- Lifetime gifts to reduce IHT

With much higher interest rates available on deposits and bonds and with changes in pension rules and capital gains tax treatment, please do make full use of your adviser to make sure you are not missing a ‘legitimate’ trick.

Fund in Focus: Franklin Templeton Clearbridge Global Infrastructure

Full portfolio performance analysis and macro commentary for the third quarter is now available online for review. Please speak to your Wealth manager if you are unsure how to access this.

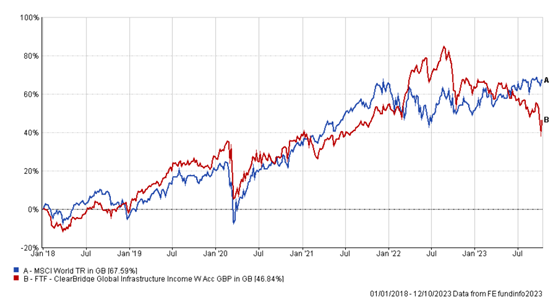

As covered in the review, one of the weaker performing funds within portfolios was our allocation to Global infrastructure run by Clearbridge, part of the Franklin Templeton group. Real Assets continue to be the biggest headwind to portfolio returns in 2023 with Real Estate and Infrastructure in particular struggling performance wise due to rising base rates and long-term yields. Although there will always be volatility in portfolios, we think markets are mispricing the growth and inflation protection built into the Global Infrastructure universe, as they did back in 2018 where yields also increased significantly throughout the year.

FTF Global Infrastructure:

- Cash and inflation beating yields: Forward Looking yield of 5.5% is higher than can be gained from cash and dividend growth of 5.3% annualised is set to compound ahead of inflation.

- Attractive valuations: Internal rate of return has been between 8% and 16% historically since the funds inception and is now currently towards the very top end of the range. Although not a guide to the future, historically returns have had a strong correlation over the last ten years. Markets will continue to be volatile over short periods particularly when the macroeconomic picture is unclear.

- Secular growth story – Misunderstanding of infrastructure companies. Net zero target a tailwind (think decarbonisation and electrification) for infrastructure investors with significant investment required to meet these targets. Utility companies are no longer growing at between one and two percent as they have done historically and are therefore being wrongly cast and trading like bond proxies as longer-term yields have risen.

- Strong Balance Sheets: Utility companies have spent last 10 years refinancing at low rates with an average duration of liabilities of over 10 years – Think how some UK consumers have benefited from fixing their mortgage liabilities for five years versus two years and are yet to feel the pain of higher borrowing costs.

- Performance parallels: Performance of the fund also struggled compared to Global Equities in 2018 (-11.23% at low point – scale of chart below hides this) with rising yields also acting as headwind to fund performance. Upon normalisation, markets assessed company fundamentals rather than macro concerns with strong performance versus higher risk Global Equity index in the aftermath. Global Equity relative performance predominantly from Magnificent 7, otherwise flat for the year.

Source: FE Analytics 13/10/23

- Risk is not the same as volatility: Although the share prices of the underlying have been volatile, this does not mean they are riskier. Revenues are often linked to inflation through regulation or long-term contracts – Inflation has been higher than interest rates in many parts of the world. Furthermore, the portfolio is defensively positioned: 72% of portfolio in Utilities – less sensitive to GDP with only c.25% in more economically sensitive user pays assets (Airports, toll Roads etc.)

- The content of this document is for information purposes only and should not be construed as financial advice.

- Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

- We always recommend that you seek professional regulated financial advice before investing.