There has been a distinct mood swing in investor risk appetite this month coming from a number of factors:

- Increased political risk with the outbreak of conflict in the Middle East,

- a continued increase in long duration bond yields is increasing valuation risk for equities,

- and a mixed set of company earnings reports are highlighting stock specific risks in equities.

The Middle East conflicts make investors nervous and have the potential to lift oil prices which in turn would lift inflation encouraging central banks to keep interest rates high.

Rising bond yields are being driven higher by a stronger than expected economy in the US, the reverse of quantitative easing and the high levels of government debt that now need financing. These higher yields make investing in bonds more attractive, which in turn puts pressure on equity prices as those who manage money decide whether to allocate money to risky equity markets or move their investors’ funds to the calmer waters of earning bond interest.

Whilst day-to-day short-term traders in equities speculate over short term price moves, every three months longer term investors in equities get a window into how companies are actually doing. This revelation is particularly interesting now as we see which companies can deal with, and in some cases benefit from, higher inflation and higher interest rates and which ones can’t.

The Impact on Our Portfolios

Last 12 Months Returns

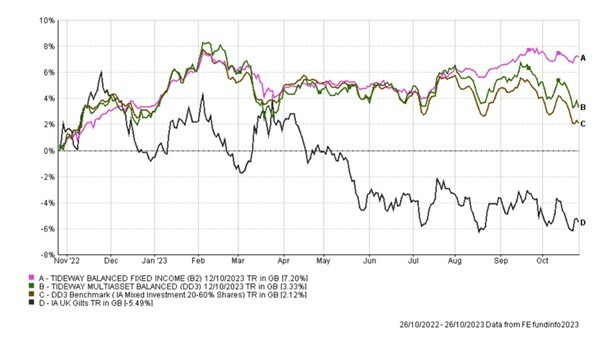

The chart below shows Tideway Fixed Income portfolio returns (A) versus our mixed asset returns (B) benchmark mixed asset returns (C) and longer duration UK Gilts (D).

There are a few points to note here:

1. The massive gap in performance, more than 12% in 12 months, between our fixed income portfolio and gilts.

This has been achieved by being short duration, we mostly invested in bonds with less than 6 years to maturity, and the expertise of our managers to buy higher yielding corporate bonds whilst avoiding defaults. Whilst the argument for passive v active investments will rumble on in equities, in fixed income for us it’s very clear, active management of duration and credit risk really works.

2. The divergence since July between the Tideway fixed income portfolio and the mixed asset portfolio and its peer group.

Whilst at times it might look like all investments are going up and down at the same time and by the same amount this shows something very different. The short duration fixed income portfolios are not without a bit of volatility, but it’s much less now than multi asset funds. These funds might go sideways or down for a bit but the 6%-8% coupons earned are keeping them broadly on track.

These bond fund holdings in our mixed asset portfolios are now reducing volatility. I noted this morning that as Wednesday’s market movements (the Nasdaq fell 2.5% in one day) feed into fund prices and portfolio returns, Tideway’s clients’ money fell 0.4% on the day overall. I can see that many of our competitors will have seen a 1.5% drop overall in their client’s funds in a single day.

Sometimes it’s not how much you make but how much you don’t lose.

The Magnificent Seven

There has been much talk about the seven shares adding to returns in the leading US stock index, the S&P 500. On September 1st fund manager and massive provider of passive funds BlackRock noted:

Today, the Magnificent Seven make up 28% of the S&P 500 Index and have contributed almost 65% of the S&P 500 Index YTD returns.

This has been a real headache for active managers in US companies, who can see the risks in investing in some of these companies at current valuations. Should they buy more of these stocks to try and keep up with the index?

As the earnings results come in, we are starting to get the answers, many active managers will be relieved, they are not mad! Is Tesla really a magnificent company? Regular readers of this column will know my views.

Price source: Yahoo Finance: 27th October 2023

According to research by Tideway’s most recent addition to its investment analyst team, Costa Michaelides, when you multiply out these returns by the company’s weightings within the S&P 500, the six highest contributing companies to the indexes fall since the 17th October to yesterday’s close were, in order of negative contribution: Apple, Tesla, Amazon, Alphabet, Nvidia and Meta. Though in fairness to Amazon, it looks like it will move out of this list today, after good results last night see it trading 6% up in the pre-market as I write.

In the words of Warren Buffet: “If something can’t keep going up for ever it won’t” and clearly earnings matter.

I added Intel, as we have looked at this company before which is one of the top holdings in Schroder’s Global Equity Income Fund and is benefiting from the interest in high-end chips driven by AI, but coming from a low valuation. It will be interesting to see how Nvidia fares on the 21st November with its earnings. Nvidia’s shares are priced for huge future growth, it had better not disappoint.

Of course, as share prices fall, some of the valuation risks gets removed, the fall in price makes the shares less risky. The outlook in the US, as confirmed by our macro analysts TS Lombard, is complex. The economy is stronger than analysts (including TS Lombard) expected – probably due to the cash reserves of households coming out of the Covid lockdowns and bolstered by loose monetary policy and Government cash handouts in this period. US consumers are less sensitive to interest rates than in the UK, they have long term fixed rate mortgages so did not benefit from the ultra-low mortgage rates that borrowers enjoyed in the UK.

The strong view from TS Lombard is not to bet against the US economy and the US stock market dominance in the medium term. We have been underweight US shares since we started Tideway, and it has hurt our overall relative performance. We are looking closely at this.

Risks Still to Impact

In the UK there has been much focus on the domestic housing market as the adjustment to higher interest rates impacts as borrowers move to the higher rates. The impact on commercial property was further highlighted this month as first M&G and then St James’s Place suspended dealings in their property funds, locking in clients, there is likely still quite a bit of pain to be worked out in this sector.

Many businesses small and large are also leveraged and will struggle with higher interest rates. The leveraged buyout market in particular has been on a massive buying spree in the last decade driven by cheap money. Some investors will have overpaid.

Anecdotally, Tideway senior management met with a UK SME business lender this week to look at the facilities now available in the new world. It’s very clear money is no longer cheap, and as the conversation moved to covenants, an off the cuff comment that maybe c50% of the current loan book borrowers were breaching covenants was a strong reminder how leverage dramatically increases business risks when interest rates rise.

Nick will now look at some of the changes we have made to portfolios. Two points from me on this:

1. The team have really been putting in the effort to try and make the best decisions on any portfolio moves. Sharing data, looking at fund returns and interviews, considering the outlook and putting questions through to and listening to our Macro Analysts TS Lombard. If these moves don’t work out, it will not be through lack of thought and effort.

2. We have to be careful around signalling what we are doing in advance. Whilst we aren’t BlackRock, if we want to move say 10% of our portfolios that’s £40m and we always want to complete the move before the wider market knows what we are thinking. We will of course let you know as moves are completed.

- The content of this document is for information purposes only and should not be construed as financial advice.

- Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

- We always recommend that you seek professional regulated financial advice before investing.