There has been some relief in the last few weeks as softer inflation data in both the US and Europe took the pressure off further base rate rises and let longer dated bonds rally.

There was no change in base rates, but as longer dated bonds rallied and yields fell, so equities rallied in tandem. This has lifted all our portfolios with the mixed asset portfolios rising by around 3.5% in just 4 weeks.

This movement sets the tone for what we hear when we listen to the great and good in investment management. Nick and Costa both do this on a weekly basis, but our advisers also go out regularly and listen to investment managers speak as part of our CPD programme and three of them were at AJ Bell’s investment conference yesterday.

By the way those who make a living from investment management tend to have very strong views on this stuff!

- Those who think inflation will stay high are generally bearish…they think equity markets will fall and are buying gold, holding cash and US TIPs (inflation linked treasury bills) as protection against a stock market fall and long-term inflation.

- Those who think inflation will be lower are bullish …. they think long duration bonds and equity markets will rise now and are buying smaller companies, emerging markets and other areas of global equity markets that have not performed well in the last few years expecting a strong rebound.

There has been some relief in the last few weeks as softer inflation data in both the US and Europe took the pressure off further base rate rises and let longer dated bonds rally.

There was no change in base rates, but as longer dated bonds rallied and yields fell, so equities rallied in tandem. This has lifted all our portfolios with the mixed asset portfolios rising by around 3.5% in just 4 weeks.

This movement sets the tone for what we hear when we listen to the great and good in investment management. Nick and Costa both do this on a weekly basis, but our advisers also go out regularly and listen to investment managers speak as part of our CPD programme and three of them were at AJ Bell’s investment conference yesterday.

By the way those who make a living from investment management tend to have very strong views on this stuff!

1. Those who think inflation will stay high are generally bearish…they think equity markets will fall and are buying gold, holding cash and US TIPs (inflation linked treasury bills) as protection against a stock market fall and long-term inflation.

2. Those who think inflation will be lower are bullish …. they think long duration bonds and equity markets will rise now and are buying smaller companies, emerging markets and other areas of global equity markets that have not performed well in the last few years expecting a strong rebound.

There is a 3rd but ever present and powerful group of investors in equity markets who don’t really care about this stuff, they have bought into the passive approach to investing and just buy the index.

These days that’s the US index or World Index. There is not much difference in these indices now which are both focused on a handful of US mega cap companies, whose share prices keep rising as more investors move into these indices, following the herd.

In the last week I have been looking at returns on our various funds this year and saw the impact of this 3rd class of investors. The US large cap index is up around 16% year to date and has roughly doubled the return on every other global equity fund, with other more sector specific funds showing roughly flat returns for the year.

Looking more closely, this phenomenon is largely a function of the last six months.

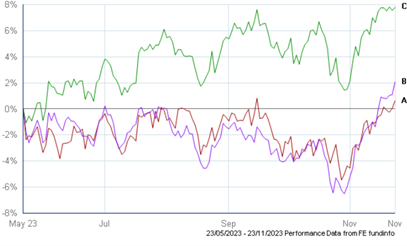

Here is our Heriot Global equity fund and Fidelity’s passive US Index fund, both of which we hold in our portfolios, and the mighty Fundsmith Equity Fund which we don’t own, over the last six months.

This level of diversity in returns in such a short time period is not normal and it’s well documented that this is down to the fact that these active managers are more diversified in their holdings than the index. Now the emergence of the mega cap US tech firms whose huge market cap now dominate the index and whose share prices are being driven up more quickly than the firm’s underlying profits are rising.

The passive brigade will highlight it as the poor performance of active managers, when what is really happening is a speculative price rise driven up by momentum rather than earnings. Those with a keen eye for a chart will note the gap in performance at around 8% by the end of October, narrowed by 2% in November, as the active managers have beaten the index.

So, what are we thinking and doing?

We are trying to avoid speculating too much over the short-term path of inflation. Inflation is notoriously difficult to predict. The last 18 months has shown that higher inflation is very much alive after a long period when you might have thought it had been banished for ever. But there could still be some very powerful deflationary forces around from technology, AI in particular, and climate change agendas.

We constantly remind ourselves that this is a long-term game and long- term cash has offered poor returns and that gold and US TIPs have been both volatile and offer no or very little income. Without the underpin of regular income they are by definition more speculative.

Share prices, as they become divorced from the profitability of businesses, become ever more speculative. For younger people on the make this can be an exciting game.

But Terry Smith at Fundsmith, Warren Buffet at Berkshire Hathaway and Alan Macfarlane at Dundas Partners, who manages Heriot Global, know that price and profits matter when investing in shares. Even when it comes to the most exciting businesses in the world, momentum ultimately gives way to fundamental values, the piper must be paid at some point! It can take a while and it means underperforming at times, but the discipline of avoiding over valued companies does protect the downside risk when the bubble bursts and makes investing in shares less risky. It also improves returns going forwards as there is more room for such companies share prices to rise.

Berkshire Hathaway’s performance around the turn of the century and the dot com crash was a spectacular example of this:

Berkshire Hathaway

(white) vs S&P 500 index (orange)

Source: Bloomberg

- We have some US index exposure, but we are not betting the ranch on it, we will keep faith with our active managers’ processes and efforts to filter out over-valued companies and to invest beyond just US big tech for diversification. • We aren’t going to hold pure cash, or buy gold, or TIPs, speculating inflation will be higher than current expectations.

- We aren’t going to hold pure cash, or buy gold, or TIPs, speculating inflation will be higher than current expectations.

- We will continue to hold shorter dated fixed income with known and attractive returns, which we have been de-risking a little of late, taking advantage of better yields in lower risk bonds. We think these funds will do well now even if equity markets dip.

- We are also starting to add a bit of longer duration bond exposure which are now offering attractive returns and would protect portfolios if inflation fell faster than expected, for example if a recession appeared, which most have now written off, but which could still happen and is overdue.

In short, we try and make sure each investment should be able to make a decent inflation plus return over the longer term and try to create some diversification to lower the risk to unexpected events.

The good news is this process is a good deal easier to do today with inflation at 5.6% and most likely heading lower in the short term and base interest rates at 5.25% than back in 2021 when inflation was 2% and rising steeply but interest rates were zero.

We did note in the last few weeks that on some days when markets rallied those funds that we hold in smaller companies, emerging markets and our property REIT fund, which have been our worse performing funds of late, went up the most.

This is the investment group number 2 noted above getting their confidence back and looking for value. Nick will now look at this in a bit more detail below and particularly around our smaller companies funds.

Strategy in Focus: Smaller Companies

Rather than discuss the merits of an individual fund, we will instead examine the broader theme of investing in smaller companies; why they are a good addition to any long-term portfolio and why now, more than ever this might be the case.

The simplest argument for investing in smaller companies is that over the longer term they should return more than their large capitalisation equivalents. This makes sense intuitively when thinking about risk and return more broadly:

Government securities (debt – you cannot buy a share in the government!) must pay higher returns than cash to entice people to dispense with the interest they receive from their bank accounts (where investor deposits are insured up to £85,000 currently). This logic extends further with investing in the debt of companies rather than the government (think Artemis Corporate Bond and Royal London Short Duration Credit) where should companies wish to borrow, they will need to beat the rate offered by governments – otherwise why would you lend to a corporate at the same rate considering the former proposition is generally considered risk free. Investors in Equities therefore will require the potential for greater returns than corporate bonds, after all they are taking more risk being lower down in the capital structure and priority of payments in the event of company insolvency – except if you owned certain corporate bonds in a former Swiss Bank! This logic is generally accepted though admittedly there are certain moments where any one of these asset classes is trading at relatively attractive levels in risk adjusted returns.

It stands to reason therefore that investors purchasing a broad basket of smaller companies will require a greater return than a similar basket of larger companies. All else being equal and using the same logic as above investing in smaller companies is a riskier proposition than larger companies: Potentially have difficulty accessing capital in different economic conditions, perhaps a more inexperienced management team or even dependent on just a few customers being some examples of increased risk.

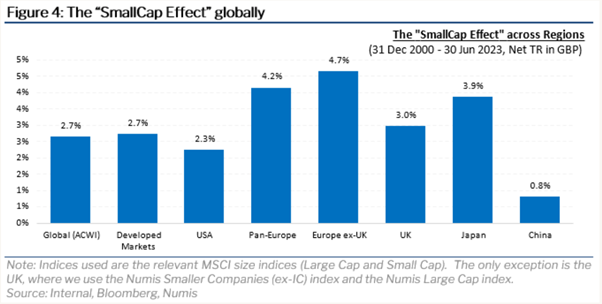

Luckily this risk return theory is backed up by longer term returns – the smaller company premium (the formal term for what is being described above) holding true. Courtesy of the MSCI, smaller companies have outperformed large companies by 2.7% annualised from the end of 1998 to the end of 2022. Although this might not seem a lot, the chart below quickly illustrates how this incremental return compounds over the long term:

Cedric Durant des Aulnois, CEO of Montanaro Asset Management, in an article ‘Why investors should be looking at SmallCap now’, dated May 19 this year delves into the small cap premium further and looks at this premium across regions (31 Dec 2000 – 30 Jun 2023).

As noted from the chart above smaller companies have performed better than their large cap counterparts in every single developed market region over this time period. Cedric goes onto show that when adding volatility numbers into the equation to calculate risk adjusted returns all regions bar the USA performed better than their large cap counterparts and were therefore compensated for the additional risk being taken (Return of the FAANGs from 2009 proving the primary reason for this exception).

Due to both higher returns and higher risk adjusted returns, Tideway think small caps should form a part of any investment plan long which is long enough to withstand the increased volatility of small caps due to the rewards on offer and is therefore a component (along with the less risky asset classes mentioned at the beginning of the piece) of all of Tideway’s diversified Multi-Asset portfolios.

To emphasise, even though the long term returns on offer have been higher than other asset classes, like equities more generally they can potentially underperform lower risk asset classes for extended periods and is hence why owning in isolation is most likely not a good idea for most investors; in Tideway portfolios there are other shorter duration assets to pick up the slack over periods of time where smaller companies are underperforming, which mitigates sequencing risk for those withdrawing from their pots – meaning not a forced seller of assets whilst they are underperforming.

Smaller companies are in the midst of one of these periods where they are underperforming their large capitalisation equivalents with a particularly bad year in 2022 and now also looking relatively poor five-year basis. Hoping that the longer-term opportunities have been made clear, we also think there is a potential shorter term more tactical opportunity with attractive valuations and fundamentals and potential tailwinds from falling inflation which disproportionately benefit small caps.

Valuations & Fundamentals: As a result of an extended period of underperformance small cap valuations in general are trading at discounts to their long-term averages and versus their larger cap counterparts on multiple valuation metrics. An example from one of our managers – Unicorn UK Income – Data below as of 31st October 2023.

Valuations: Yield 5.7% >40% premium to the FTSE All Share. Yield alone now comfortably covers headline inflation and returns available on government bonds as well as parts of the investment grade fixed income market.

Earnings Per Share growth 2024: 9.7% (Bloomberg consensus forecast) EPS growth at close to double digits only expanding the available Net Income from which future higher dividends can be paid. Evidence that this high yield is not in lieu of future growth.

Dividend Cover: 2.1x – Usually dividend yields this high are not well covered by Net Income thereby sacrificing future growth opportunities by not reinvesting in the respective businesses. Furthermore, a period of relatively poor operational performance can lead to dividend cuts which is normally always a catalyst for poor share price performance. That is not the case here with the healthy dividend covered twice over.

Net cash across the portfolio 62%. One potential knock on small capitalisation companies is that they have weaker balance sheets than their large cap counterparts which makes them more sensitive to changes in yield. In this case 62% of the companies can pay all total outstanding liabilities from their current cash balances.

Price to Earnings Ratio: In simplified terms there are two components of share price return; company operational performance (Earnings) – which can be controlled to some extent, and what the market is willing to pay for this operational performance (Price). Currently the market is only willing to pay 11.5x forward earnings (30% below long-term average), with all but one of the 33 companies in the portfolio trading at long term average.

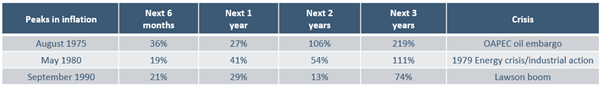

Performance after periods of peak inflation:

As a relatively long duration asset class (more potential earnings than current earnings) particularly high inflation and rising interest rates have historically tended to act as a headwind to smaller companies. The opposite is true once inflation has peaked with performance typically being strong. A reminder that past performance is not a guide to future returns:

Source: Unicorn Asset management, Numis and ONS, 30 September 2023

In conclusion, although small caps have underperformed other asset classes as of late, hopefully the long-term benefits of holding these companies over the long term has been understood. Furthermore, this period of poor performance represents an opportunity from our perspective with cheap valuations and a more beneficial macroeconomic environment potentially reigniting returns. Our small cap specialists selecting and interrogating these underlying companies are Unicorn and Montanaro Asset Management.

• The content of this document is for information purposes only and should not be construed as financial advice.

• Please be aware that the value of investments, and the income you may receive from them, cannot be guaranteed and may fall as well as rise.

• We always recommend that you seek professional regulated financial advice before investing.